PEC700

Storyboard Text

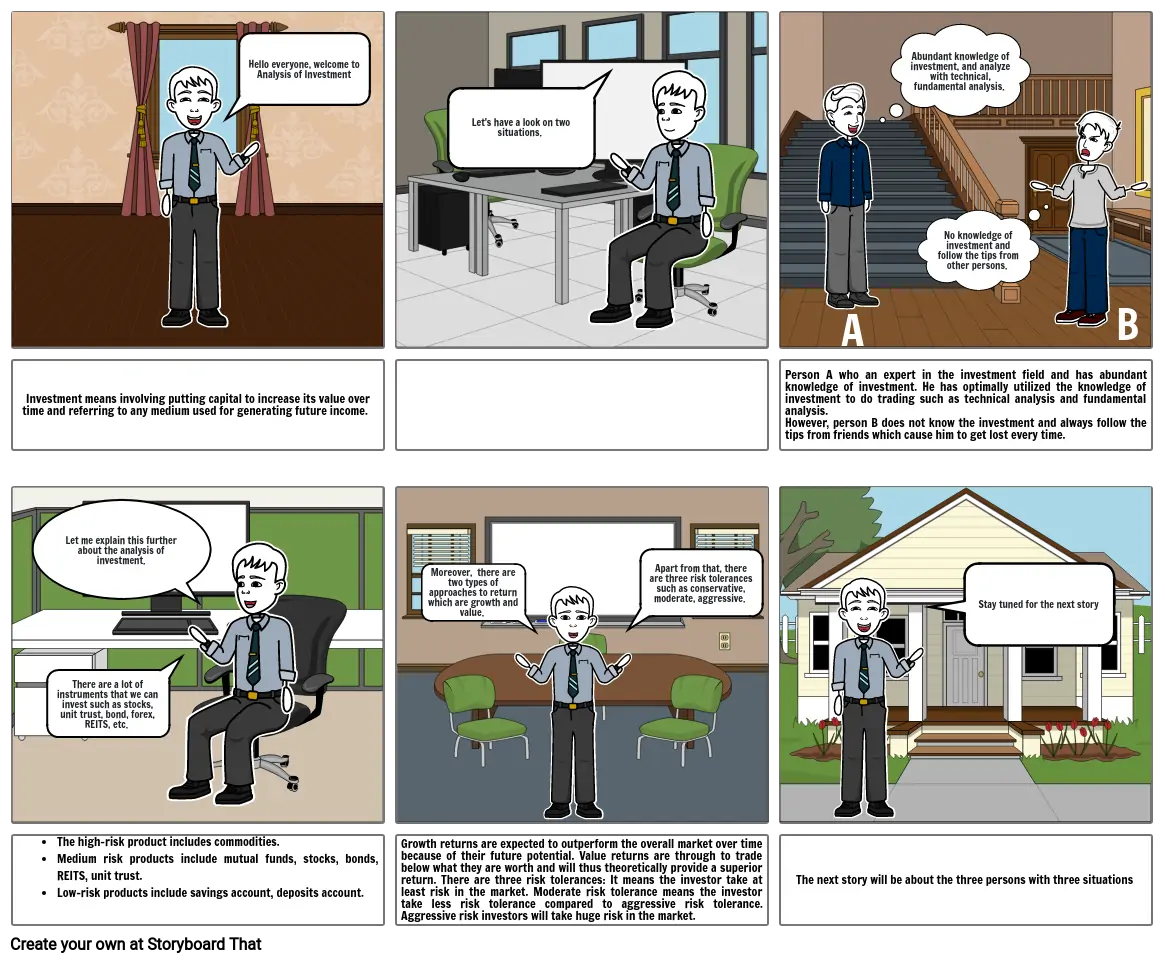

- Hello everyone, welcome to Analysis of Investment

- Let's have a look on two situations.

- A

- Abundant knowledge of investment, and analyze with technical, fundamental analysis.

- No knowledge of investment and follow the tips from other persons.

- B

- Investment means involving putting capital to increase its value over time and referring to any medium used for generating future income.

- Let me explain this further about the analysis of investment.

- There are a lot of instruments that we can invest such as stocks, unit trust, bond, forex, REITS, etc.

- Moreover, there are two types of approaches to return which are growth and value.

- Apart from that, there are three risk tolerances such as conservative, moderate, aggressive.

- Person A who an expert in the investment field and has abundant knowledge of investment. He has optimally utilized the knowledge of investment to do trading such as technical analysis and fundamental analysis. However, person B does not know the investment and always follow the tips from friends which cause him to get lost every time.

- Stay tuned for the next story

- The high-risk product includes commodities.Medium risk products include mutual funds, stocks, bonds, REITS, unit trust. Low-risk products include savings account, deposits account.

- Growth returns are expected to outperform the overall market over time because of their future potential. Value returns are through to trade below what they are worth and will thus theoretically provide a superior return. There are three risk tolerances: It means the investor take at least risk in the market. Moderate risk tolerance means the investor take less risk tolerance compared to aggressive risk tolerance. Aggressive risk investors will take huge risk in the market.

- The next story will be about the three persons with three situations

Over 30 Million Storyboards Created