wingstop

Storyboard-Text

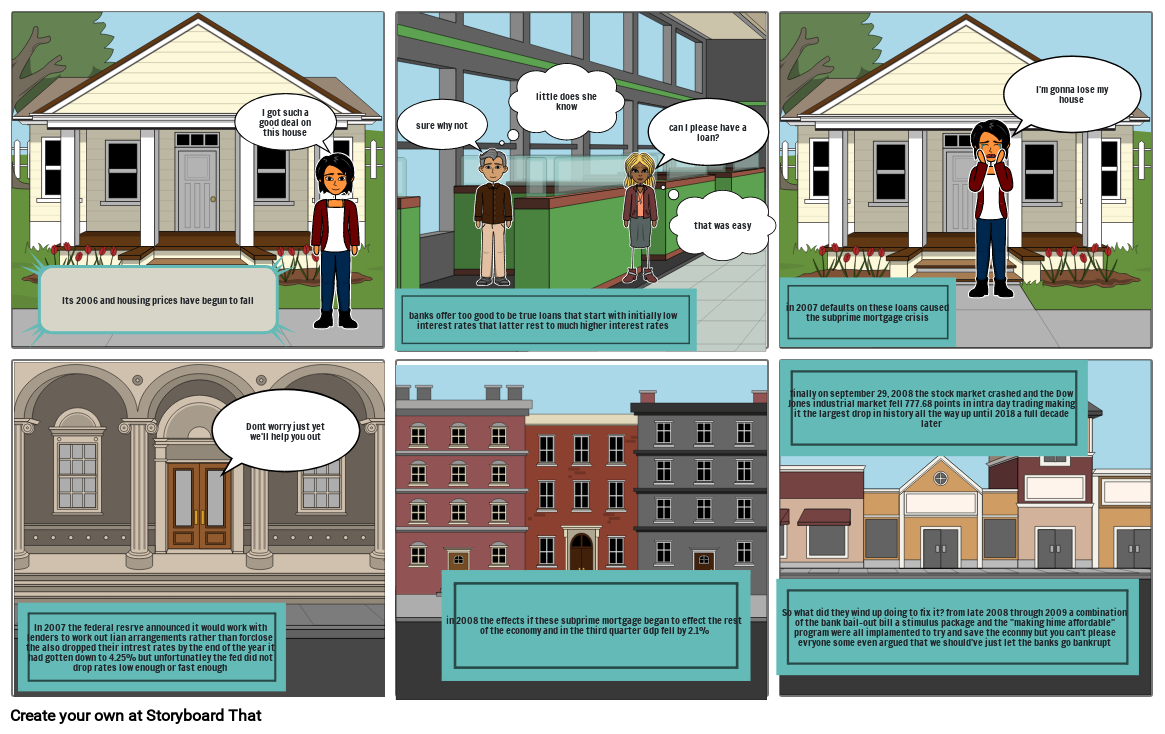

- Its 2006 and housing prices have begun to fall

- I got such a good deal on this house

- banks offer too good to be true loans that start with initially low interest rates that latter rest to much higher interest rates

- sure why not

- little does she know

- can I please have a loan?

- that was easy

- in 2007 defaults on these loans caused the subprime mortgage crisis

- I'm gonna lose my house

- In 2007 the federal resrve announced it would work with lenders to work out lian arrangements rather than forclosethe also dropped their intrest rates by the end of the year it had gotten down to 4.25% but unfortunatley the fed did not drop rates low enough or fast enough

- Dont worry just yet we'll help you out

- in 2008 the effects if these subprime mortgage began to effect the rest of the economy and in the third quarter Gdp fell by 2.1%

- So what did they wind up doing to fix it? from late 2008 through 2009 a combination of the bank bail-out bill a stimulus package and the making hime affordable program were all implamented to try and save the econmy but you can't please evryone some even argued that we should've just let the banks go bankrupt

- finally on september 29, 2008 the stock market crashed and the Dow Jones industrial market fell 777.68 points in intra day trading making it the largest drop in history all the way up until 2018 a full decade later

Über 30 Millionen erstellte Storyboards

Keine Downloads, Keine Kreditkarte und Kein Login zum Ausprobieren Erforderlich!