Unknown Story

Testo Storyboard

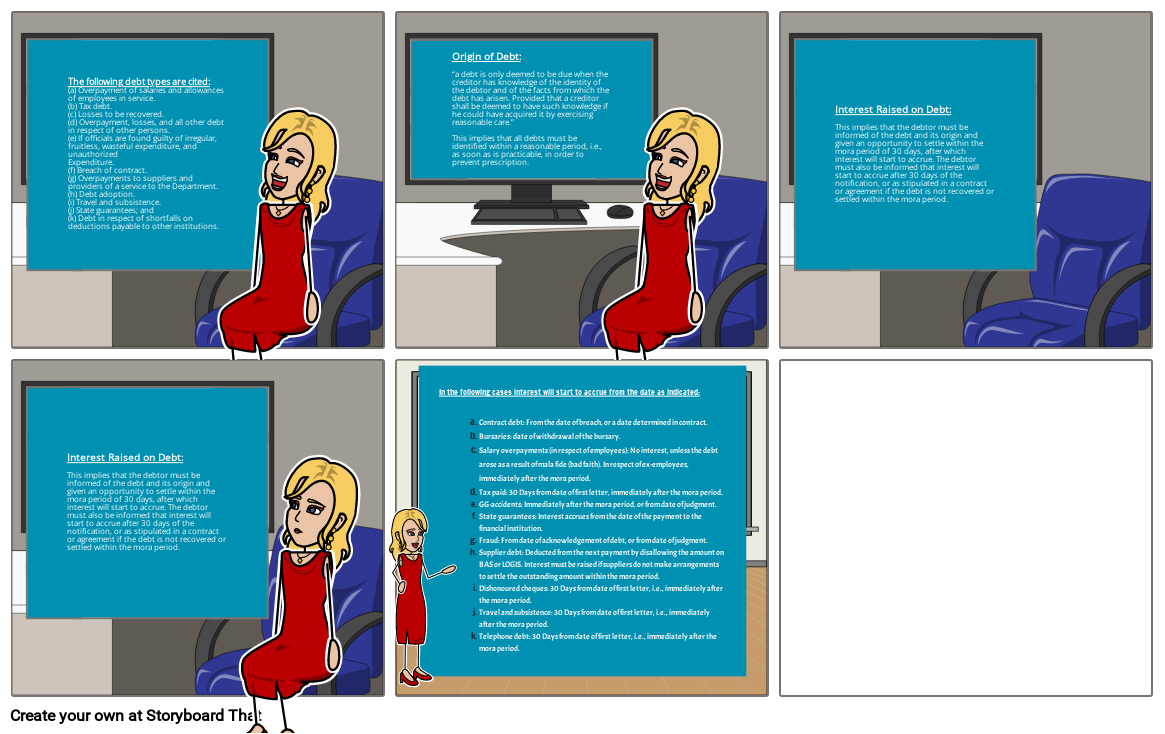

- The following debt types are cited:(a) Overpayment of salaries and allowances of employees in service.(b) Tax debt.(c) Losses to be recovered.(d) Overpayment, losses, and all other debt in respect of other persons.(e) If officials are found guilty of irregular, fruitless, wasteful expenditure, and unauthorized Expenditure.(f) Breach of contract.(g) Overpayments to suppliers and providers of a service to the Department.(h) Debt adoption.(i) Travel and subsistence.(j) State guarantees; and(k) Debt in respect of shortfalls on deductions payable to other institutions.

- Origin of Debt:“a debt is only deemed to be due when the creditor has knowledge of the identity of the debtor and of the facts from which the debt has arisen. Provided that a creditor shall be deemed to have such knowledge if he could have acquired it by exercising reasonable care.” This implies that all debts must be identified within a reasonable period, i.e.,as soon as is practicable, in order to prevent prescription.

- Interest Raised on Debt:This implies that the debtor must be informed of the debt and its origin and given an opportunity to settle within the mora period of 30 days, after which interest will start to accrue. The debtor must also be informed that interest will start to accrue after 30 days of the notification, or as stipulated in a contractor agreement if the debt is not recovered or settled within the mora period.

- Interest Raised on Debt:This implies that the debtor must be informed of the debt and its origin and given an opportunity to settle within the mora period of 30 days, after which interest will start to accrue. The debtor must also be informed that interest will start to accrue after 30 days of the notification, or as stipulated in a contractor agreement if the debt is not recovered or settled within the mora period.

- In the following cases interest will start to accrue from the date as indicated:Contract debt: From the date of breach, or a date determined in contract.Bursaries: date of withdrawal of the bursary. Salary overpayments (in respect of employees): No interest, unless the debt arose as a result of mala fide (bad faith). In respect of ex-employees, immediately after the mora period.Tax paid: 30 Days from date of first letter, immediately after the mora period.GG-accidents: Immediately after the mora period, or from date of judgment.State guarantees: Interest accrues from the date of the payment to the financial institution.Fraud: From date of acknowledgement of debt, or from date of judgment.Supplier debt: Deducted from the next payment by disallowing the amount on BAS or LOGIS. Interest must be raised if suppliers do not make arrangements to settle the outstanding amount within the mora period.Dishonoured cheques: 30 Days from date of first letter, i.e., immediately after the mora period.Travel and subsistence: 30 Days from date of first letter, i.e., immediately after the mora period.Telephone debt: 30 Days from date of first letter, i.e., immediately after the mora period.

Oltre 30 milioni di storyboard creati