Paying off debt

Storyboard Text

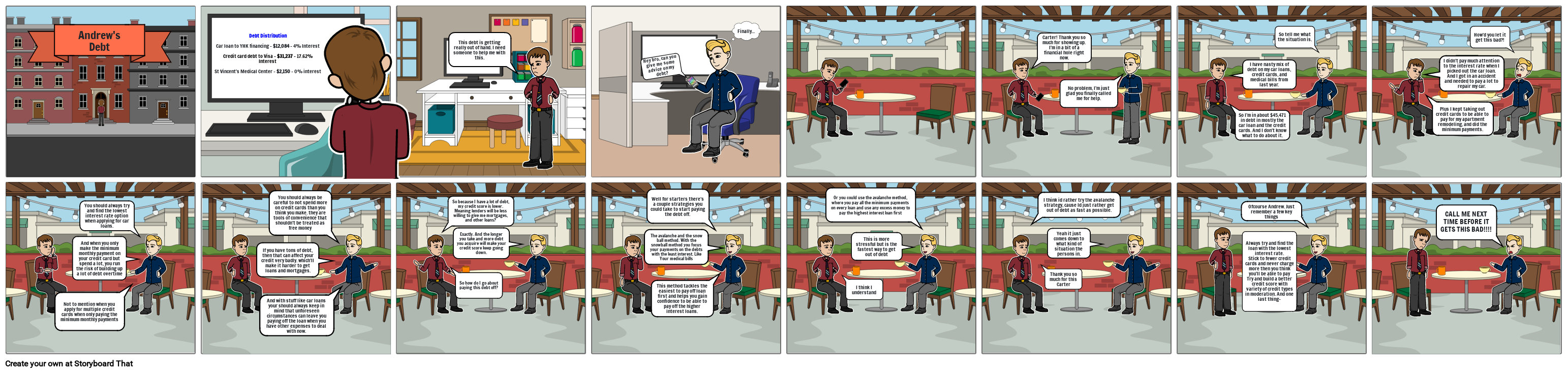

- Debt Distribution Car loan to YHK financing - $12,084 - 4% Interest Credit card debt to Visa - $31,237 - 17.62% Interest St Vincent's Medical Center - $2,150 - 0% interest

- This debt is getting really out of hand. I need someone to help me with this.

- Hey bro, can you give me some advice on my debt?

- Finally...

- Carter! Thank you so much for showing up. I'm in a bit of a financial hole right now.

- No problem, I'm just glad you finally called me for help.

- I have nasty mix of debt on my car loans, credit cards, and medical bills from last year.

- So I'm in about $45,471 in debt in mostly the car loan and the credit cards. And I don't know what to do about it.

- So tell me what the situation is.

- I didn't pay much attention to the interest rate when I picked out the car loan. And I got in an accident and needed to pay a lot to repair my car.

- Plus I kept taking out credit cards to be able to pay for my apartment remodeling, and did the minimum payments.

- How'd you let it get this bad?!

- Not to mention when you apply for multiple credit cards when only paying the minimum monthly payments

- You should always try and find the lowest interest rate option when applying for car loans.

- And when you only make the minimum monthly payment on your credit card but spend a lot, you run the risk of building up a lot of debt overtime

- And with stuff like car loans your should always keep in mind that unforeseen circumstances can leave you paying off the loan when you have other expenses to deal with now.

- You should always be careful to not spend more on credit cards than you think you make. they are tools of convenience that shouldn't be treated as free money

- If you have tons of debt, then that can affect your credit very badly. which'll make it harder to get loans and mortgages.

- So because I have a lot of debt, my credit score is lower. Meaning lenders will be less willing to give me mortgages, and other loans?

- So how do I go about paying this debt off?

- Exactly. And the longer you take and more debt you acquire will make your credit score keep going down.

- Well for starters there's a couple strategies you could take to start paying the debt off.

- This method tackles the easiest to pay off loan first and helps you gain confidence to be able to pay off the higher interest loans.

- The avalanche and the snow ball method. With the snowball method you focus your payments on the debts with the least interest. Like Your medical bills

- Or you could use the avalanche method, where you pay all the minimum payments on every loan and use any excess money to pay the highest interest loan first

- I think I understand

- This is more stressful but is the fastest way to get out of debt

- I think id rather try the avalanche strategy, cause Id just rather get out of debt as fast as possible.

- Thank you so much for this Carter

- Yeah it just comes down to what kind of situation the persons in.

- Ofcourse Andrew. Just remember a few key things

- Always try and find the loan with the lowest interest rate.Stick to fewer credit cards and never charge more then you think you'll be able to payTry and build a better credit score with variety of credit types in moderation. And one last thing-

- CALL ME NEXT TIME BEFORE IT GETS THIS BAD!!!!

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!