Monetary vs. Fiscal Policy

Storyboard Text

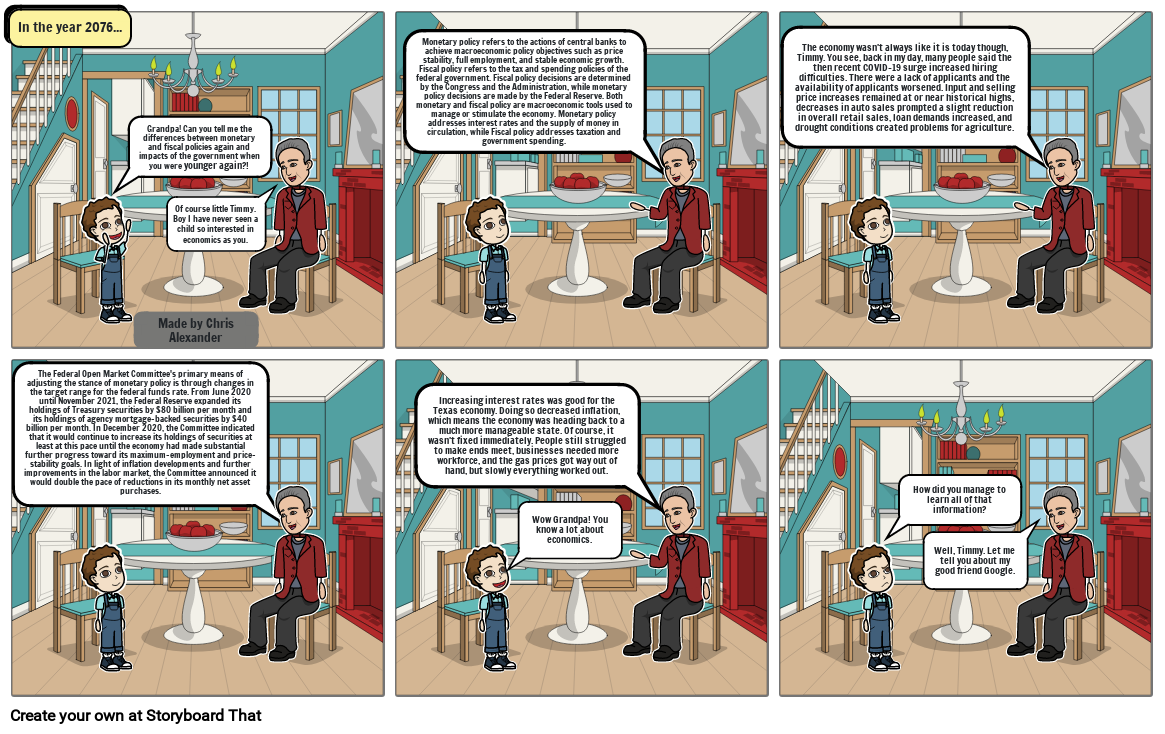

- In the year 2076...

- Grandpa! Can you tell me the differences between monetary and fiscal policies again and impacts of the government when you were younger again?!

- Made by Chris Alexander

- Of course little Timmy. Boy I have never seen a child so interested in economics as you.

- Monetary policy refers to the actions of central banks to achieve macroeconomic policy objectives such as price stability, full employment, and stable economic growth. Fiscal policy refers to the tax and spending policies of the federal government. Fiscal policy decisions are determined by the Congress and the Administration, while monetary policy decisions are made by the Federal Reserve. Both monetary and fiscal policy are macroeconomic tools used to manage or stimulate the economy. Monetary policy addresses interest rates and the supply of money in circulation, while Fiscal policy addresses taxation and government spending.

- The economy wasn't always like it is today though, Timmy. You see, back in my day, many people said the then recent COVID-19 surge increased hiring difficulties. There were a lack of applicants and the availability of applicants worsened. Input and selling price increases remained at or near historical highs, decreases in auto sales prompted a slight reduction in overall retail sales, loan demands increased, and drought conditions created problems for agriculture.

- The Federal Open Market Committee's primary means of adjusting the stance of monetary policy is through changes in the target range for the federal funds rate. From June 2020 until November 2021, the Federal Reserve expanded its holdings of Treasury securities by $80 billion per month and its holdings of agency mortgage-backed securities by $40 billion per month. In December 2020, the Committee indicated that it would continue to increase its holdings of securities at least at this pace until the economy had made substantial further progress toward its maximum-employment and price-stability goals. In light of inflation developments and further improvements in the labor market, the Committee announced it would double the pace of reductions in its monthly net asset purchases.

- Increasing interest rates was good for the Texas economy. Doing so decreased inflation, which means the economy was heading back to a much more manageable state. Of course, it wasn't fixed immediately. People still struggled to make ends meet, businesses needed more workforce, and the gas prices got way out of hand, but slowly everything worked out.

- Wow Grandpa! You know a lot about economics.

- How did you manage to learn all of that information?

- Well, Timmy. Let me tell you about my good friend Google.

Over 30 Million Storyboards Created