EVOLUTION OF PHILIPPINE TAXATION

Storyboard Text

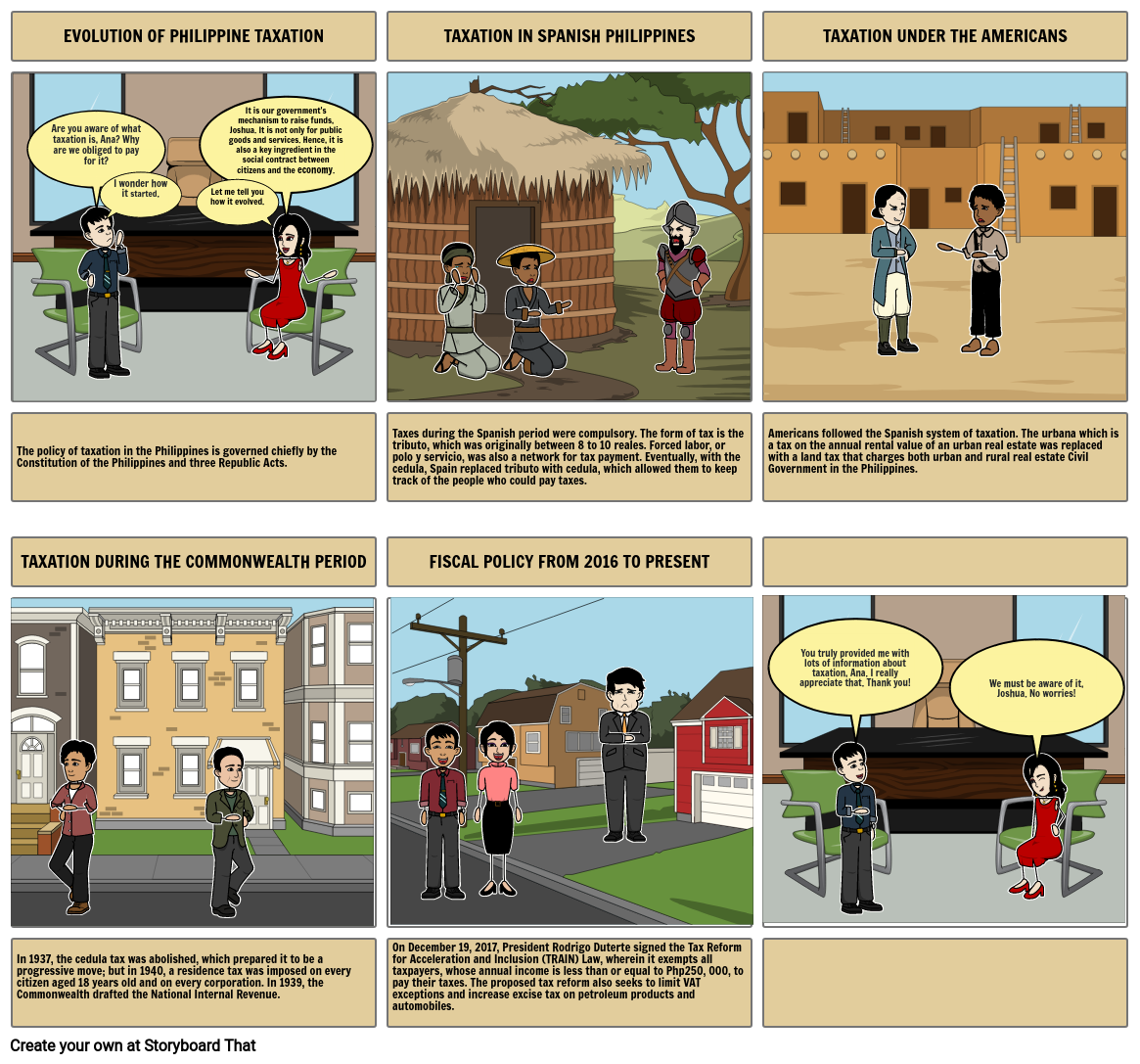

- EVOLUTION OF PHILIPPINE TAXATION

- Are you aware of what taxation is, Ana? Why are we obliged to pay for it?

- I wonder how it started.

- Let me tell you how it evolved.

- It is our government's mechanism to raise funds, Joshua. It is not only for public goods and services. Hence, it is also a key ingredient in the social contract between citizens and the economy.

- TAXATION IN SPANISH PHILIPPINES

- TAXATION UNDER THE AMERICANS

- The policy of taxation in the Philippines is governed chiefly by the Constitution of the Philippines and three Republic Acts.

- TAXATION DURING THE COMMONWEALTH PERIOD

- Taxes during the Spanish period were compulsory. The form of tax is the tributo, which was originally between 8 to 10 reales. Forced labor, or polo y servicio, was also a network for tax payment. Eventually, with the cedula, Spain replaced tributo with cedula, which allowed them to keep track of the people who could pay taxes.

- FISCAL POLICY FROM 2016 TO PRESENT

- Americans followed the Spanish system of taxation. The urbana which is a tax on the annual rental value of an urban real estate was replaced with a land tax that charges both urban and rural real estate Civil Government in the Philippines.

- You truly provided me with lots of information about taxation, Ana. I really appreciate that. Thank you!

- We must be aware of it, Joshua. No worries!

- In 1937, the cedula tax was abolished, which prepared it to be a progressive move; but in 1940, a residence tax was imposed on every citizen aged 18 years old and on every corporation. In 1939, the Commonwealth drafted the National Internal Revenue.

- On December 19, 2017, President Rodrigo Duterte signed the Tax Reform for Acceleration and Inclusion (TRAIN) Law, wherein it exempts all taxpayers, whose annual income is less than or equal to Php250, 000, to pay their taxes. The proposed tax reform also seeks to limit VAT exceptions and increase excise tax on petroleum products and automobiles.

Over 30 Million Storyboards Created