Unknown Story

Storyboard Text

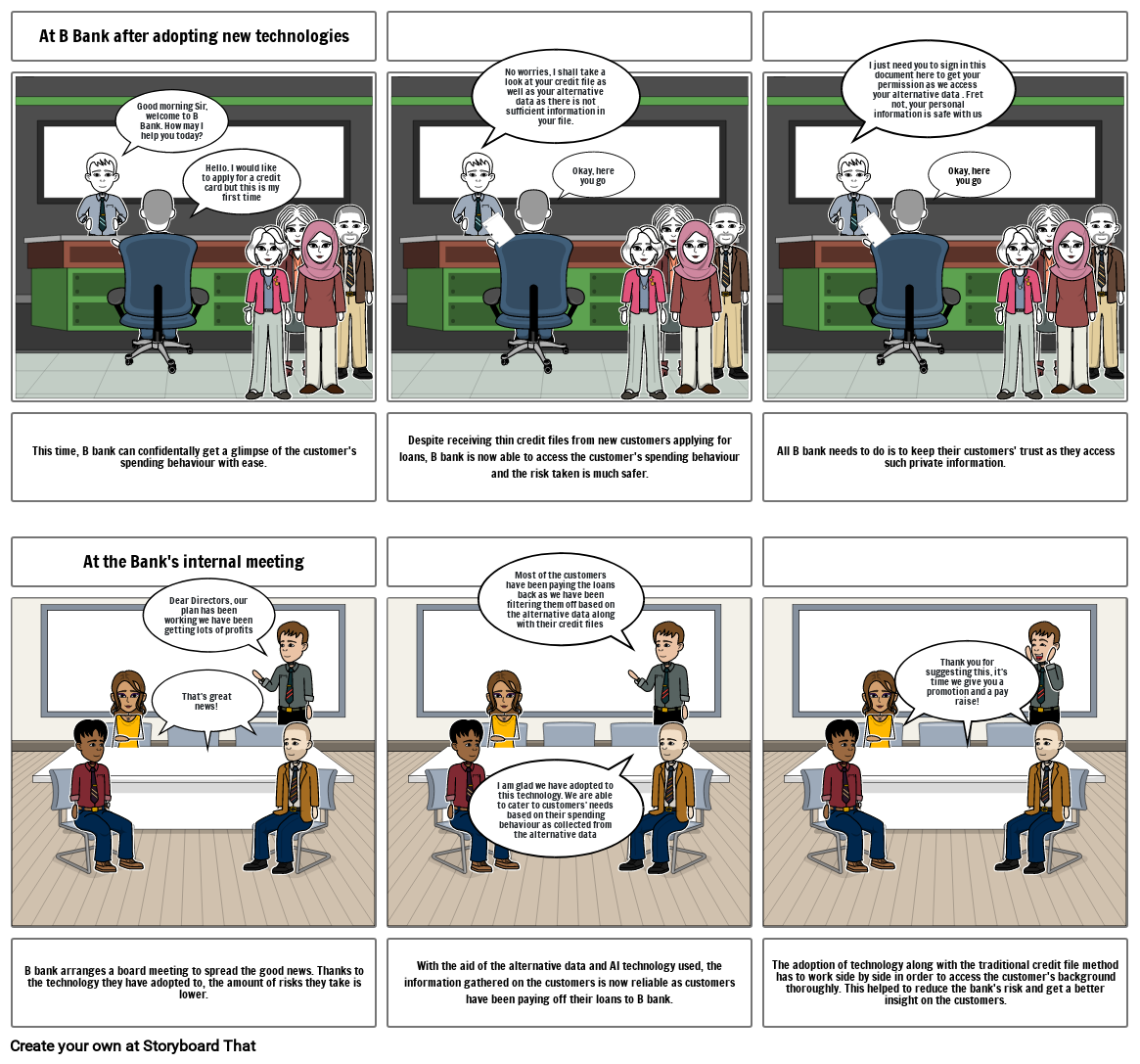

- At B Bank after adopting new technologies

- Good morning Sir, welcome to B Bank. How may I help you today?

- Hello. I would like to apply for a credit card but this is my first time

- No worries, I shall take a look at your credit file as well as your alternative data as there is not sufficient information in your file.

- Okay, here you go

- I just need you to sign in this document here to get your permission as we access your alternative data . Fret not, your personal information is safe with us

- Okay, here you go

- This time, B bank can confidentally get a glimpse of the customer's spending behaviour with ease.

- At the Bank's internal meeting

- Dear Directors, our plan has been working we have been getting lots of profits

- That's great news!

- Despite receiving thin credit files from new customers applying for loans, B bank is now able to access the customer's spending behaviour and the risk taken is much safer.

- Most of the customers have been paying the loans back as we have been filtering them off based on the alternative data along with their credit files

- All B bank needs to do is to keep their customers' trust as they access such private information.

- Thank you for suggesting this, it's time we give you a promotion and a pay raise!

- B bank arranges a board meeting to spread the good news. Thanks to the technology they have adopted to, the amount of risks they take is lower.

- With the aid of the alternative data and AI technology used, the information gathered on the customers is now reliable as customers have been paying off their loans to B bank.

- I am glad we have adopted to this technology. We are able to cater to customers' needs based on their spending behaviour as collected from the alternative data

- The adoption of technology along with the traditional credit file method has to work side by side in order to access the customer's background thoroughly. This helped to reduce the bank's risk and get a better insight on the customers.

Over 30 Million Storyboards Created