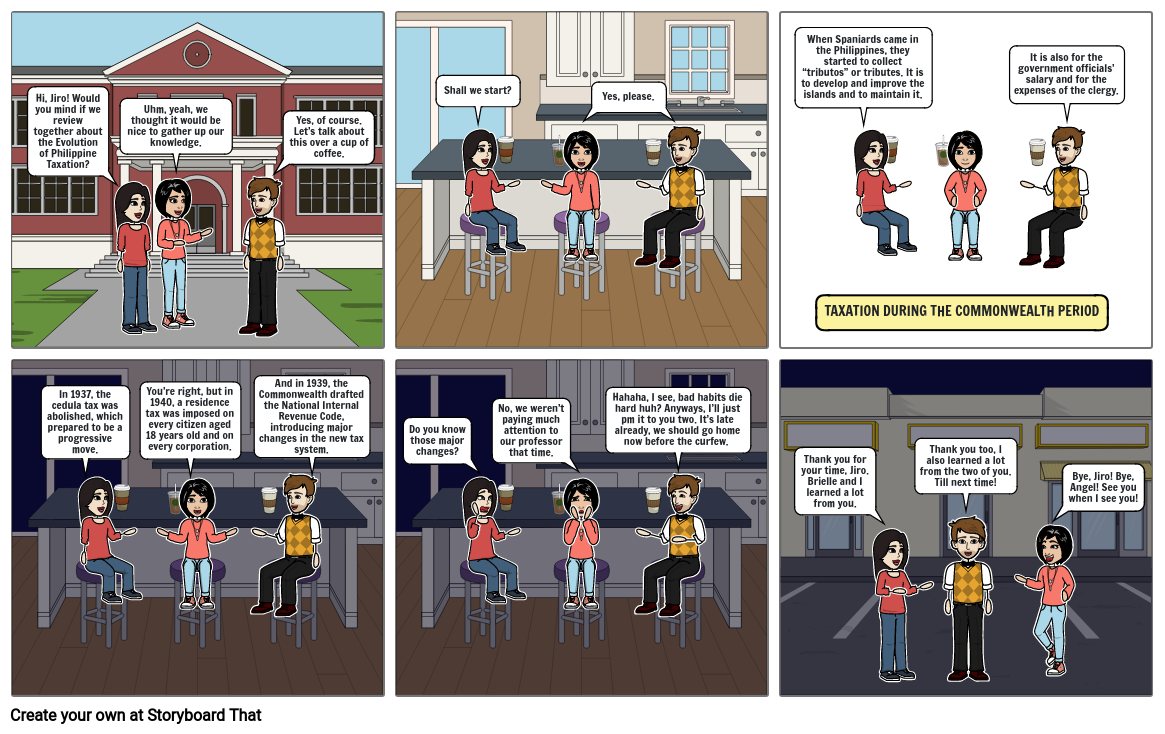

Evolution of Philippine Taxation

Storyboard Description

by Jeizel V. Concepcion (BSA 2-A)

Storyboard Text

- Hi, Jiro! Would you mind if we review together about the Evolution of Philippine Taxation?

- Uhm, yeah, we thought it would be nice to gather up our knowledge.

- Yes, of course. Let’s talk about this over a cup of coffee.

- Shall we start?

- Yes, please.

- When Spaniards came in the Philippines, they started to collect “tributos” or tributes. It is to develop and improve the islands and to maintain it.

- TAXATION DURING THE COMMONWEALTH PERIOD

- It is also for the government officials’ salary and for the expenses of the clergy.

- In 1937, the cedula tax was abolished, which prepared to be a progressive move.

- You’re right, but in 1940, a residence tax was imposed on every citizen aged 18 years old and on every corporation.

- And in 1939, the Commonwealth drafted the National Internal Revenue Code, introducing major changes in the new tax system.

- Do you know those major changes?

- No, we weren’t paying much attention to our professor that time.

- Hahaha, I see, bad habits die hard huh? Anyways, I’ll just pm it to you two. It’s late already, we should go home now before the curfew.

- Thank you for your time, Jiro. Brielle and I learned a lot from you.

- Thank you too, I also learned a lot from the two of you. Till next time!

- Bye, Jiro! Bye, Angel! See you when I see you!

Over 30 Million Storyboards Created