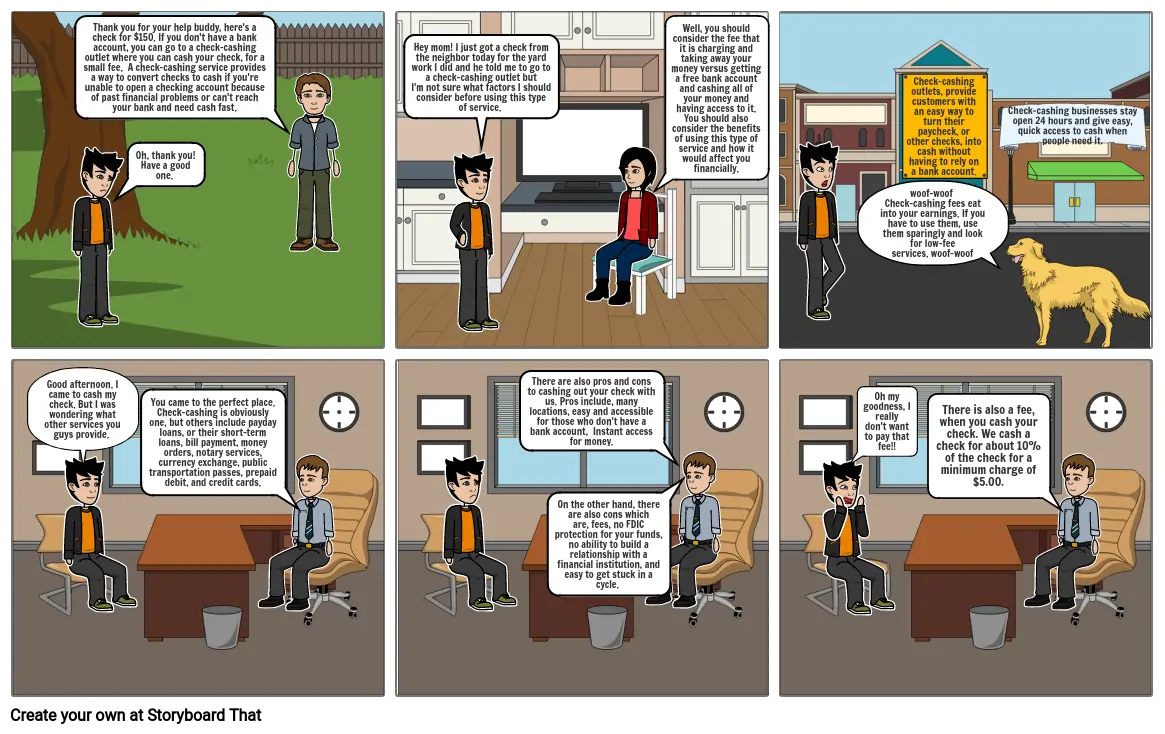

Check-Cashing Outlet

Storyboard Text

- Thank you for your help buddy, here's a check for $150. If you don't have a bank account, you can go to a check-cashing outlet where you can cash your check, for a small fee. A check-cashing service provides a way to convert checks to cash if you're unable to open a checking account because of past financial problems or can't reach your bank and need cash fast.

- Oh, thank you! Have a good one.

- Hey mom! I just got a check from the neighbor today for the yard work I did and he told me to go to a check-cashing outlet but I'm not sure what factors I should consider before using this type of service.

- Well, you should consider the fee that it is charging and taking away your money versus getting a free bank account and cashing all of your money and having access to it. You should also consider the benefits of using this type of service and how it would affect you financially.

- woof-woof Check-cashing fees eat into your earnings. If you have to use them, use them sparingly and look for low-fee services. woof-woof

- Check-cashing outlets, provide customers with an easy way to turn their paycheck, or other checks, into cash without having to rely on a bank account.

- Check-cashing businesses stay open 24 hours and give easy, quick access to cash when people need it.

- Good afternoon. I came to cash my check. But I was wondering what other services you guys provide.

- You came to the perfect place. Check-cashing is obviously one, but others include payday loans, or their short-term loans, bill payment, money orders, notary services, currency exchange, public transportation passes, prepaid debit, and credit cards.

- There are also pros and cons to cashing out your check with us. Pros include, many locations, easy and accessible for those who don’t have a bank account, Instant access for money.

- On the other hand, there are also cons which are, fees, no FDIC protection for your funds, no ability to build a relationship with a financial institution, and easy to get stuck in a cycle.

- Oh my goodness, I really don't want to pay that fee!!

- There is also a fee, when you cash your check. We cash a check for about 10% of the check for a minimum charge of $5.00.

Over 30 Million Storyboards Created