shar

Storyboard Text

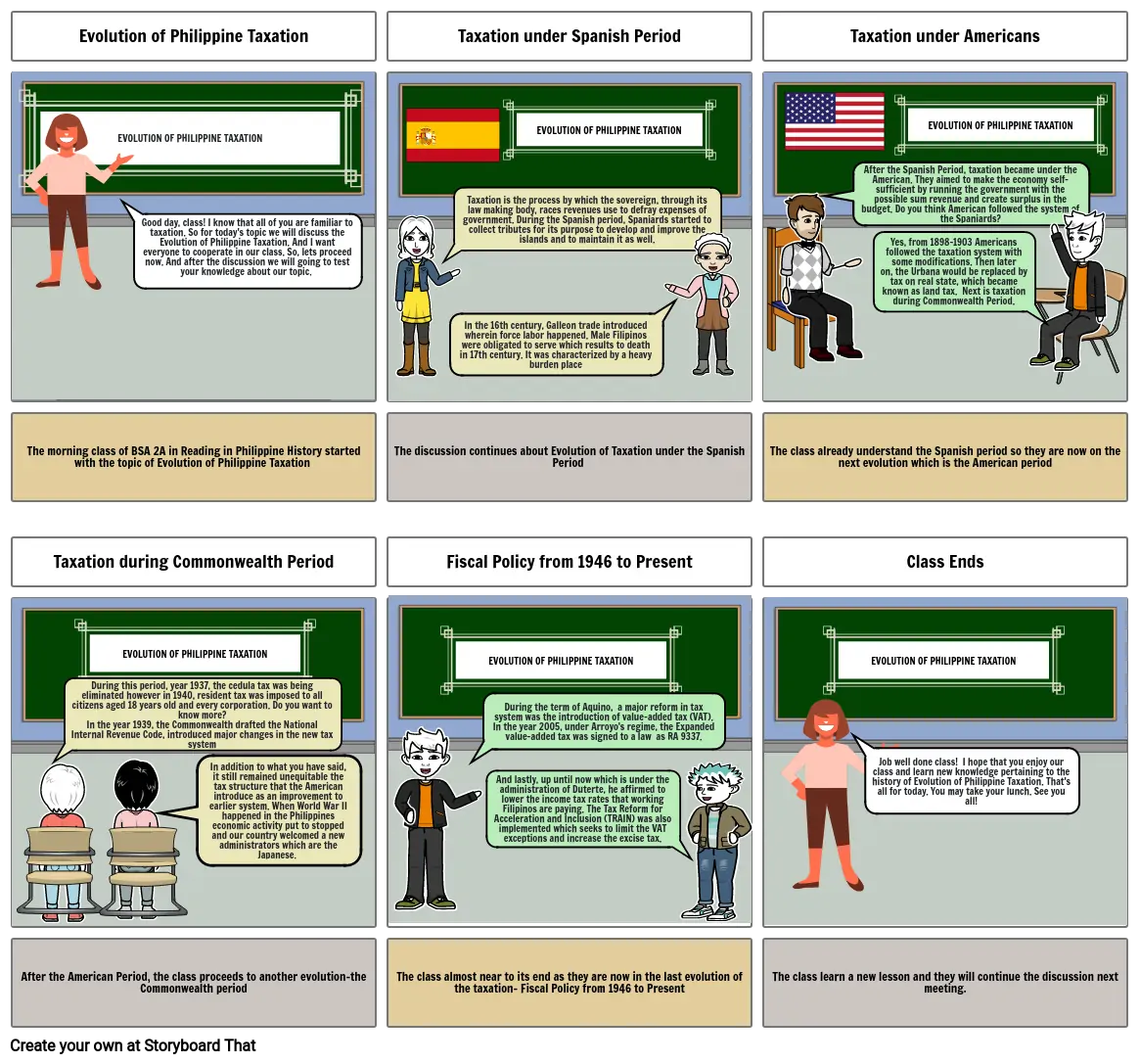

- Evolution of Philippine Taxation

- EVOLUTION OF PHILIPPINE TAXATION

- Good day, class! I know that all of you are familiar to taxation. So for today's topic we will discuss the Evolution of Philippine Taxation. And I want everyone to cooperate in our class. So, lets proceed now. And after the discussion we will going to test your knowledge about our topic.

- Taxation under Spanish Period

- Taxation is the process by which the sovereign, through its law making body, races revenues use to defray expenses of government. During the Spanish period, Spaniards started to collect tributes for its purpose to develop and improve the islands and to maintain it as well.

- In the 16th century, Galleon trade introduced wherein force labor happened. Male Filipinos were obligated to serve which results to death in 17th century. It was characterized by a heavy burden place

- EVOLUTION OF PHILIPPINE TAXATION

- Taxation under Americans

- After the Spanish Period, taxation became under the American. They aimed to make the economy self-sufficient by running the government with the possible sum revenue and create surplus in the budget. Do you think American followed the system of the Spaniards?

- Yes, from 1898-1903 Americans followed the taxation system with some modifications. Then later on, the Urbana would be replaced by tax on real state, which became known as land tax. Next is taxation during Commonwealth Period.

- EVOLUTION OF PHILIPPINE TAXATION

- The morning class of BSA 2A in Reading in Philippine History started with the topic of Evolution of Philippine Taxation

- Taxation during Commonwealth Period

- During this period, year 1937, the cedula tax was being eliminated however in 1940, resident tax was imposed to all citizens aged 18 years old and every corporation. Do you want to know more?In the year 1939, the Commonwealth drafted the National Internal Revenue Code, introduced major changes in the new tax system

- EVOLUTION OF PHILIPPINE TAXATION

- The discussion continues about Evolution of Taxation under the Spanish Period

- Fiscal Policy from 1946 to Present

- EVOLUTION OF PHILIPPINE TAXATION

- The class already understand the Spanish period so they are now on the next evolution which is the American period

- Class Ends

- EVOLUTION OF PHILIPPINE TAXATION

- After the American Period, the class proceeds to another evolution-the Commonwealth period

- In addition to what you have said, it still remained unequitable the tax structure that the American introduce as an improvement to earlier system. When World War II happened in the Philippines economic activity put to stopped and our country welcomed a new administrators which are the Japanese.

- The class almost near to its end as they are now in the last evolution of the taxation- Fiscal Policy from 1946 to Present

- During the term of Aquino, a major reform in tax system was the introduction of value-added tax (VAT). In the year 2005, under Arroyo's regime, the Expanded value-added tax was signed to a law as RA 9337.

- And lastly, up until now which is under the administration of Duterte, he affirmed to lower the income tax rates that working Filipinos are paying. The Tax Reform for Acceleration and Inclusion (TRAIN) was also implemented which seeks to limit the VAT exceptions and increase the excise tax.

- The class learn a new lesson and they will continue the discussion next meeting.

- Job well done class! I hope that you enjoy our class and learn new knowledge pertaining to the history of Evolution of Philippine Taxation. That's all for today. You may take your lunch. See you all!

Over 30 Million Storyboards Created