Unknown Story

Storyboard Text

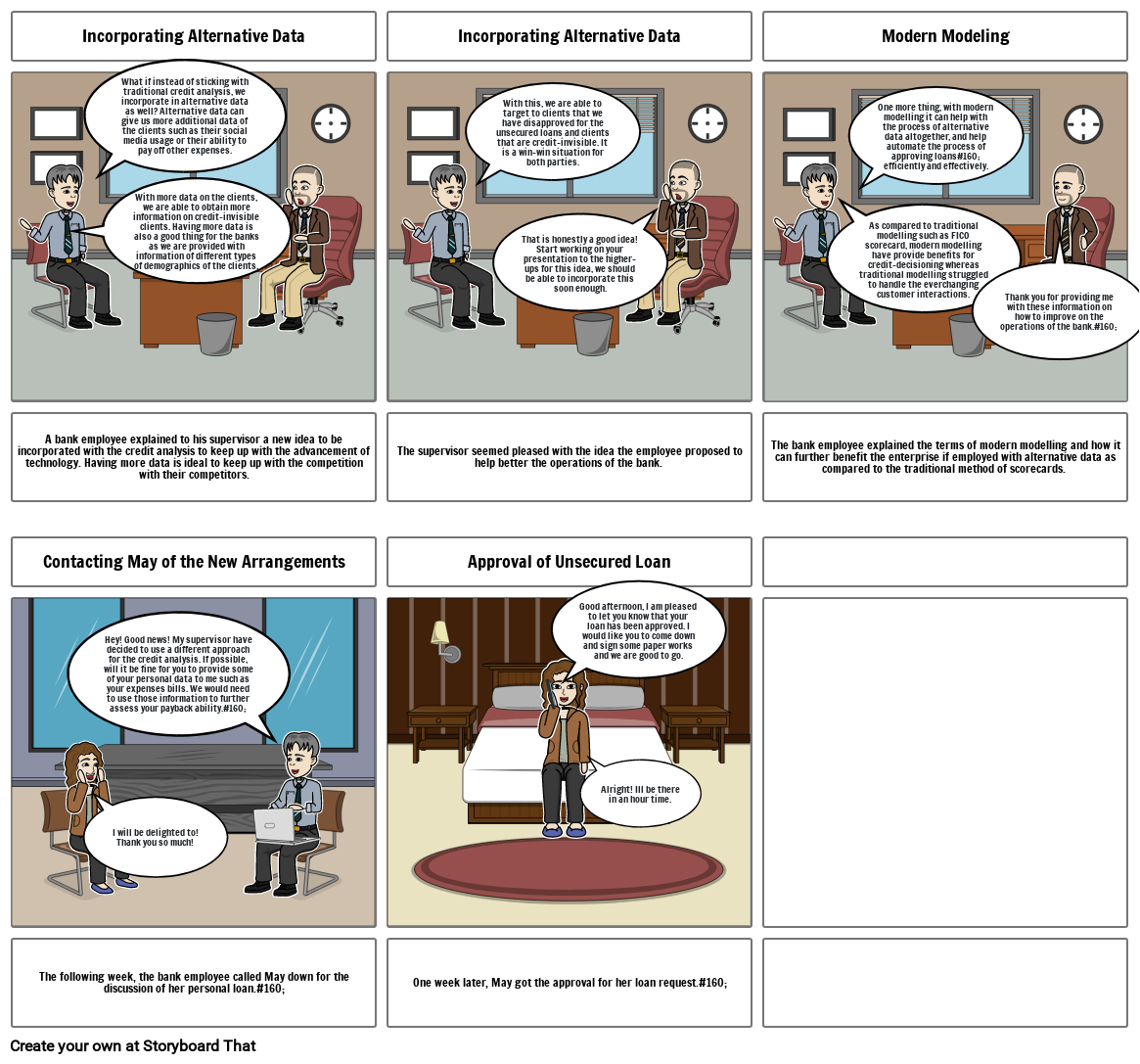

- Incorporating Alternative Data

- With more data on the clients, we are able to obtain more information on credit-invisible clients. Having more data is also a good thing for the banks as we are provided with information of different types of demographics of the clients.

- What if instead of sticking with traditional credit analysis, we incorporate in alternative data as well? Alternative data can give us more additional data of the clients such as their social media usage or their ability to pay off other expenses.

- Incorporating Alternative Data

- With this, we are able to target to clients that we have disapproved for the unsecured loans and clients that are credit-invisible. It is a win-win situation for both parties.

- That is honestly a good idea! Start working on your presentation to the higher-ups for this idea, we should be able to incorporate this soon enough.

- Modern Modeling

- As compared to traditional modelling such as FICO scorecard, modern modelling have provide benefits for credit-decisioning whereas traditional modelling struggled to handle the everchanging customer interactions.

- One more thing, with modern modelling it can help with the process of alternative data altogether, and help automate the process of approving loans#160; efficiently and effectively.

- A bank employee explained to his supervisor a new idea to be incorporated with the credit analysis to keep up with the advancement of technology. Having more data is ideal to keep up with the competition with their competitors.

- Contacting May of the New Arrangements

- Hey! Good news! My supervisor have decided to use a different approach for the credit analysis. If possible, will it be fine for you to provide some of your personal data to me such as your expenses bills. We would need to use those information to further assess your payback ability.#160;

- The supervisor seemed pleased with the idea the employee proposed to help better the operations of the bank.#160;

- Approval of Unsecured Loan

- Good afternoon, I am pleased to let you know that your loan has been approved. I would like you to come down and sign some paper works and we are good to go.

- The bank employee explained the terms of modern modelling and how it can further benefit the enterprise if employed with alternative data as compared to the traditional method of scorecards.#160;

- Thank you for providing me with these information on how to improve on the operations of the bank.#160;

- The following week, the bank employee called May down for the discussion of her personal loan.#160;

- I will be delighted to! Thank you so much!

- One week later, May got the approval for her loan request.#160;

- Alright! Ill be there in an hour time.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!