TCD 101

Storyboard Description

Basics of your new job.

Storyboard Text

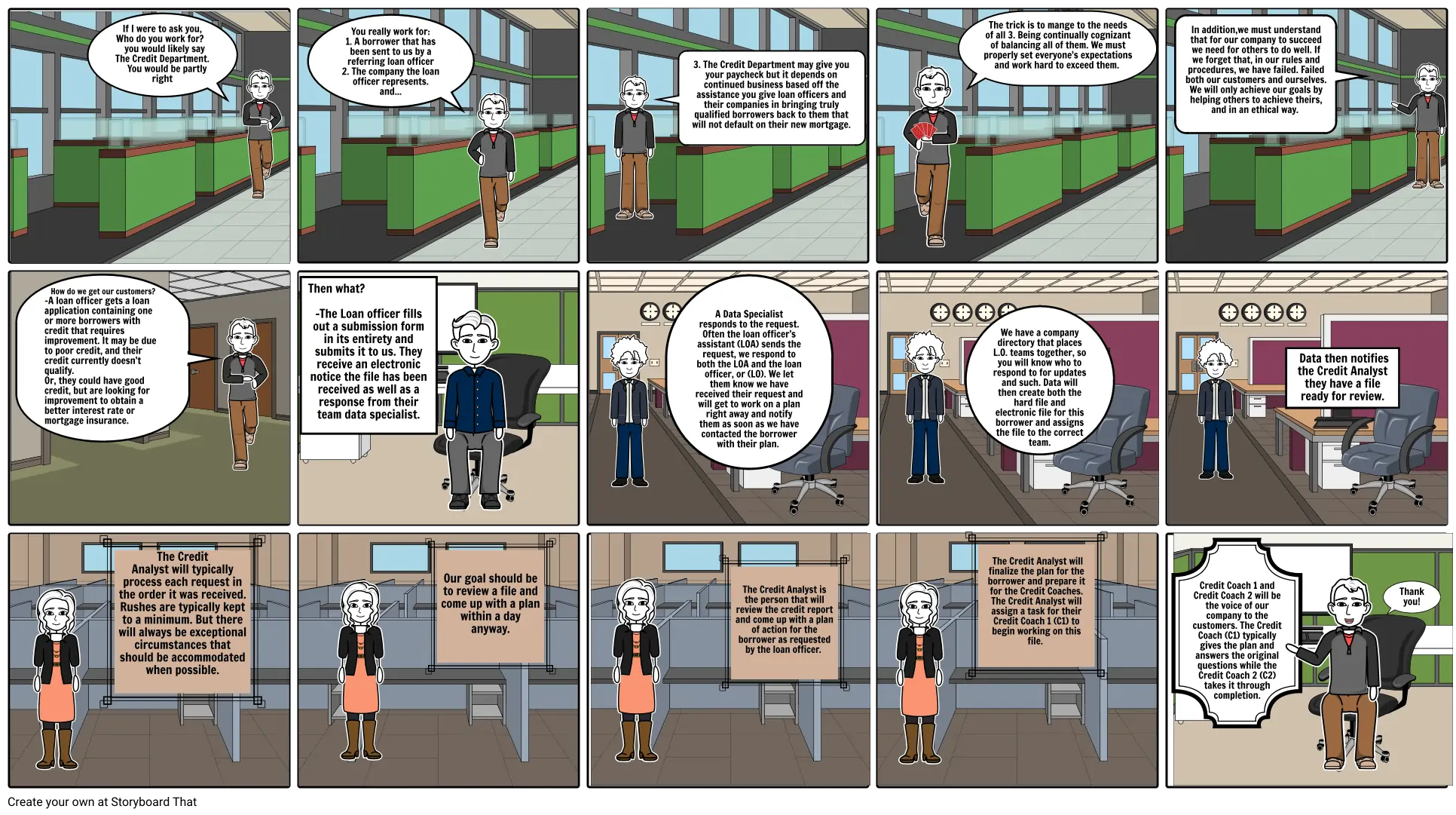

- If I were to ask you, Who do you work for? you would likely say The Credit Department. You would be partly right

- You really work for: 1. A borrower that has been sent to us by a referring loan officer 2. The company the loan officer represents. and...

- 3. The Credit Department may give you your paycheck but it depends on continued business based off the assistance you give loan officers and their companies in bringing truly qualified borrowers back to them that will not default on their new mortgage.

- The trick is to mange to the needs of all 3. Being continually cognizant of balancing all of them. We must properly set everyone's expectations and work hard to exceed them.

- In addition,we must understand that for our company to succeed we need for others to do well. If we forget that, in our rules and procedures, we have failed. Failed both our customers and ourselves. We will only achieve our goals by helping others to achieve theirs, and in an ethical way.

- How do we get our customers? -A loan officer gets a loan application containing one or more borrowers with credit that requires improvement. It may be due to poor credit, and their credit currently doesn’t qualify. Or, they could have good credit, but are looking for improvement to obtain a better interest rate or mortgage insurance.

- Then what? -The Loan officer fills out a submission form in its entirety and submits it to us. They receive an electronic notice the file has been received as well as a response from their team data specialist.

- A Data Specialist responds to the request. Often the loan officer’s assistant (LOA) sends the request, we respond to both the LOA and the loan officer, or (LO). We let them know we have received their request and will get to work on a plan right away and notify them as soon as we have contacted the borrower with their plan.

- We have a company directory that places L.O. teams together, so you will know who to respond to for updates and such. Data will then create both the hard file and electronic file for this borrower and assigns the file to the correct team.

- Data then notifies the Credit Analyst they have a file ready for review.

- The Credit Analyst will typically process each request in the order it was received. Rushes are typically kept to a minimum. But there will always be exceptional circumstances that should be accommodated when possible.

- Our goal should be to review a file and come up with a plan within a day anyway.

- The Credit Analyst is the person that will review the credit report and come up with a plan of action for the borrower as requested by the loan officer.

- The Credit Analyst will finalize the plan for the borrower and prepare it for the Credit Coaches. The Credit Analyst will assign a task for their Credit Coach 1 (C1) to begin working on this file.

- Credit Coach 1 and Credit Coach 2 will be the voice of our company to the customers. The Credit Coach (C1) typically gives the plan and answers the original questions while the Credit Coach 2 (C2) takes it through completion.

- Thank you!

Over 30 Million Storyboards Created