erthgjrfetghj

Storyboard Text

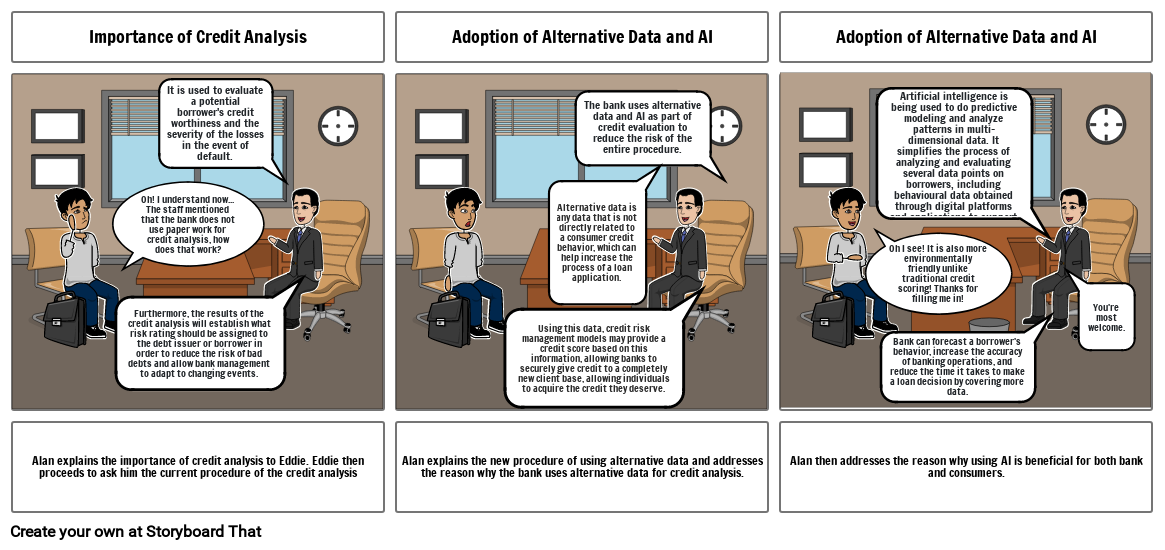

- Importance of Credit Analysis

- Oh! I understand now... The staff mentioned that the bank does not use paper work for credit analysis, how does that work?

- Furthermore, the results of the credit analysis will establish what risk rating should be assigned to the debt issuer or borrower in order to reduce the risk of bad debts and allow bank management to adapt to changing events.

- It is used to evaluate a potential borrower's credit worthiness and the severity of the losses in the event of default.

- Adoption of Alternative Data and AI

- Using this data, credit risk management models may provide a credit score based on this information, allowing banks to securely give credit to a completely new client base, allowing individuals to acquire the credit they deserve.

- Alternative data is any data that is not directly related to a consumer credit behavior, which can help increase the process of a loan application.

- The bank uses alternative data and AI as part of credit evaluation to reduce the risk of the entire procedure.

- Adoption of Alternative Data and AI

- Oh I see! It is also more environmentally friendly unlike traditional credit scoring! Thanks for filling me in!

- Artificial intelligence is being used to do predictive modeling and analyze patterns in multi-dimensional data. It simplifies the process of analyzing and evaluating several data points on borrowers, including behavioural data obtained through digital platforms and applications to support credit decisions.

- Bank can forecast a borrower's behavior, increase the accuracy of banking operations, and reduce the time it takes to make a loan decision by covering more data.

- You're most welcome.

- Alan explains the importance of credit analysis to Eddie. Eddie then proceeds to ask him the current procedure of the credit analysis

- Alan explains the new procedure of using alternative data and addresses the reason why the bank uses alternative data for credit analysis.

- Alan then addresses the reason why using AI is beneficial for both bank and consumers.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!