CBANKING

Storyboard Text

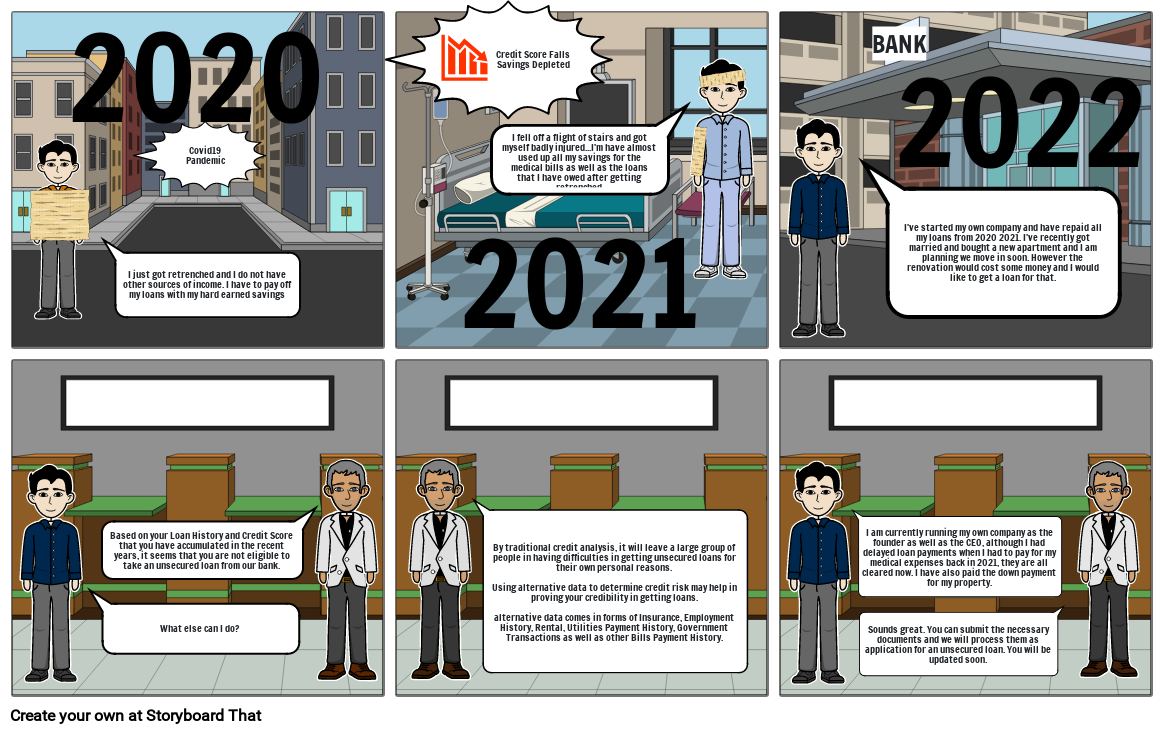

- 2020

- I just got retrenched and I do not have other sources of income. I have to pay off my loans with my hard earned savings

- Covid19 Pandemic

- Credit Score FallsSavings Depleted

- 2021

- I fell off a flight of stairs and got myself badly injured...I'm have almost used up all my savings for the medical bills as well as the loans that I have owed after getting retrenched

- BANK

- I've started my own company and have repaid all my loans from 2020 2021. I've recently got married and bought a new apartment and I am planning we move in soon. However the renovation would cost some money and I would like to get a loan for that.

- 2022

- What else can I do?

- Based on your Loan History and Credit Score that you have accumulated in the recent years, it seems that you are not eligible to take an unsecured loan from our bank.

- By traditional credit analysis, it will leave a large group of people in having difficulties in getting unsecured loans for their own personal reasons.Using alternative data to determine credit risk may help in proving your credibility in getting loans.alternative data comes in forms of Insurance, Employment History, Rental, Utilities Payment History, Government Transactions as well as other Bills Payment History.

- I am currently running my own company as the founder as well as the CEO, although I had delayed loan payments when I had to pay for my medical expenses back in 2021, they are all cleared now. I have also paid the down payment for my property.

- Sounds great. You can submit the necessary documents and we will process them as application for an unsecured loan. You will be updated soon.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!