Identity Theft (continued)

Storyboard Text

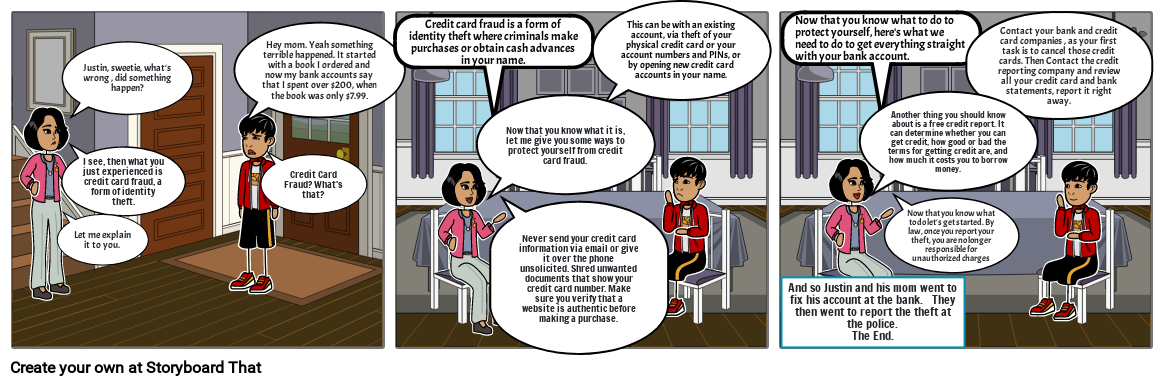

- Let me explain it to you.

- I see, then what you just experienced is credit card fraud, a form of identity theft.

- Justin, sweetie, what's wrong , did something happen?

- Hey mom. Yeah something terrible happened. It started with a book I ordered and now my bank accounts say that I spent over $200, when the book was only $7.99.

- Credit Card Fraud? What's that?

- Credit card fraud is a form of identity theft where criminals make purchases or obtain cash advances in your name.

- Now that you know what it is, let me give you some ways to protect yourself from credit card fraud.

- Never send your credit card information via email or give it over the phone unsolicited. Shred unwanted documents that show your credit card number. Make sure you verify that a website is authentic before making a purchase.

- This can be with an existing account, via theft of your physical credit card or your account numbers and PINs, or by opening new credit card accounts in your name.

- Now that you know what to do to protect yourself, here's what we need to do to get everything straight with your bank account.

- Another thing you should know about is a free credit report. It can determine whether you can get credit, how good or bad the terms for getting credit are, and how much it costs you to borrow money.

- Now that you know what to do let's get started. By law, once you report your theft, you are no longer responsible for unauthorized charges

- Contact your bank and credit card companies , as your first task is to cancel those credit cards. Then Contact the credit reporting company and review all your credit card and bank statements, report it right away.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!