Unknown Story

Storyboard Text

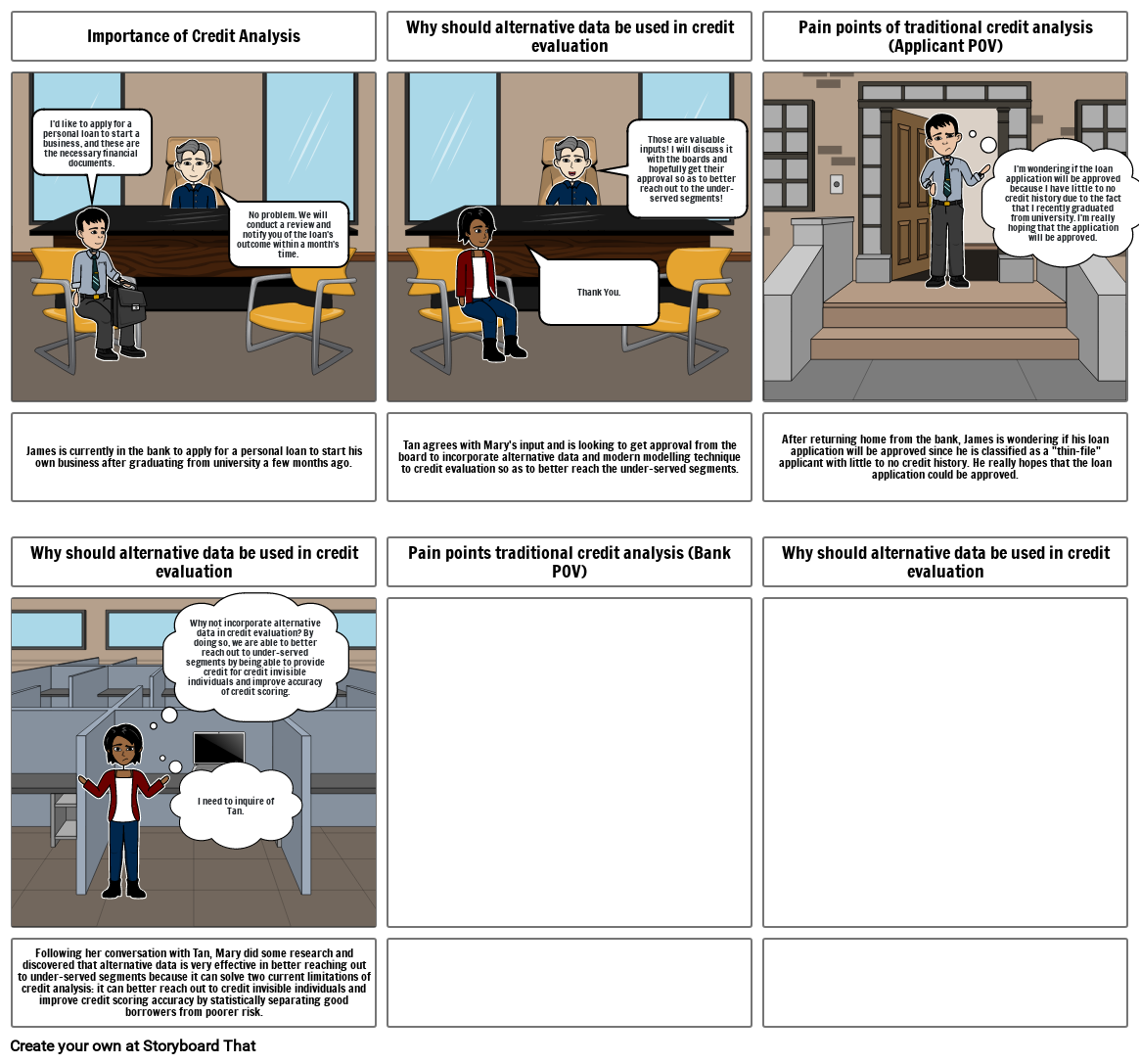

- Importance of Credit Analysis

- I'd like to apply for a personal loan to start a business, and these are the necessary financial documents.

- No problem. We will conduct a review and notify you of the loan's outcome within a month's time.

- Why should alternative data be used in credit evaluation

- Thank You.

- Those are valuable inputs! I will discuss it with the boards and hopefully get their approval so as to better reach out to the under-served segments!

- Pain points of traditional credit analysis (Applicant POV)

- I'm wondering if the loan application will be approved because I have little to no credit history due to the fact that I recently graduated from university. I'm really hoping that the application will be approved.

- James is currently in the bank to apply for a personal loan to start his own business after graduating from university a few months ago.

- Why should alternative data be used in credit evaluation

- Why not incorporate alternative data in credit evaluation? By doing so, we are able to better reach out to under-served segments by being able to provide credit for credit invisible individuals and improve accuracy of credit scoring.

- Tan agrees with Mary's input and is looking to get approval from the board to incorporate alternative data and modern modelling technique to credit evaluation so as to better reach the under-served segments.

- Pain points traditional credit analysis (Bank POV)

- After returning home from the bank, James is wondering if his loan application will be approved since he is classified as a thin-file applicant with little to no credit history. He really hopes that the loan application could be approved.

- Why should alternative data be used in credit evaluation

- Following her conversation with Tan, Mary did some research and discovered that alternative data is very effective in better reaching out to under-served segments because it can solve two current limitations of credit analysis: it can better reach out to credit invisible individuals and improve credit scoring accuracy by statistically separating good borrowers from poorer risk.

- I need to inquire of Tan.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!