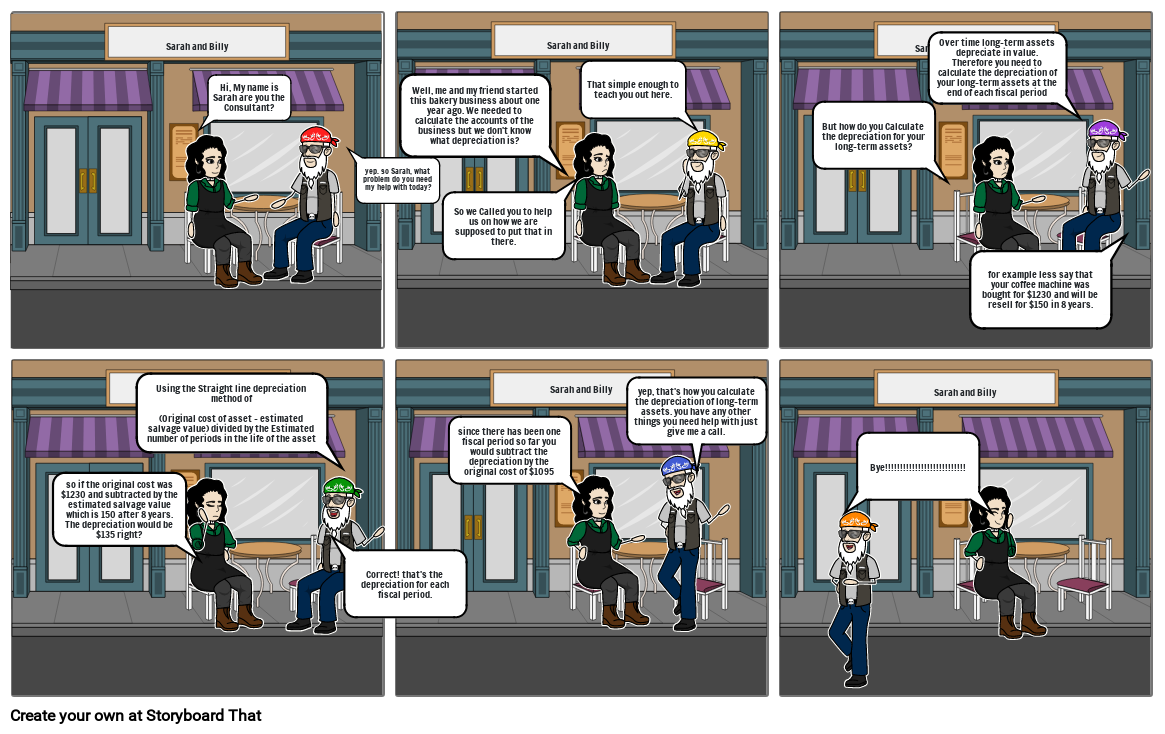

Accounting Storyboard Assignment

Storyboard Text

- Sarah and Billy

- Hi, My name is Sarah are you the Consultant?

- yep. so Sarah, what problem do you need my help with today?

- Well, me and my friend started this bakery business about one year ago. We needed to calculate the accounts of the business but we don't know what depreciation is?

- So we Called you to help us on how we are supposed to put that in there.

- Sarah and Billy

- Sarah and Billy

- That simple enough to teach you out here.

- But how do you Calculate the depreciation for your long-term assets?

- SarahandBilly

- Sarah and Billy

- Over time long-term assets depreciate in value. Therefore you need to calculate the depreciation of your long-term assets at the end of each fiscal period

- for example less say that your coffee machine was bought for $1230 and will be resell for $150 in 8 years.

- so if the original cost was $1230 and subtracted by the estimated salvage value which is 150 after 8 years. The depreciation would be $135 right?

- Using the Straight line depreciation method of (Original cost of asset – estimated salvage value) divided by the Estimated number of periods in the life of the asset

- Sarah and Billy

- Correct! that's the depreciation for each fiscal period.

- since there has been one fiscal period so far you would subtract the depreciation by the original cost of $1095

- yep, that's how you calculate the depreciation of long-term assets. you have any other things you need help with just give me a call.

- Bye!!!!!!!!!!!!!!!!!!!!!!!!!!!

Over 30 Million Storyboards Created