Investment Portfolio

Storyboard Text

- Slide: 1

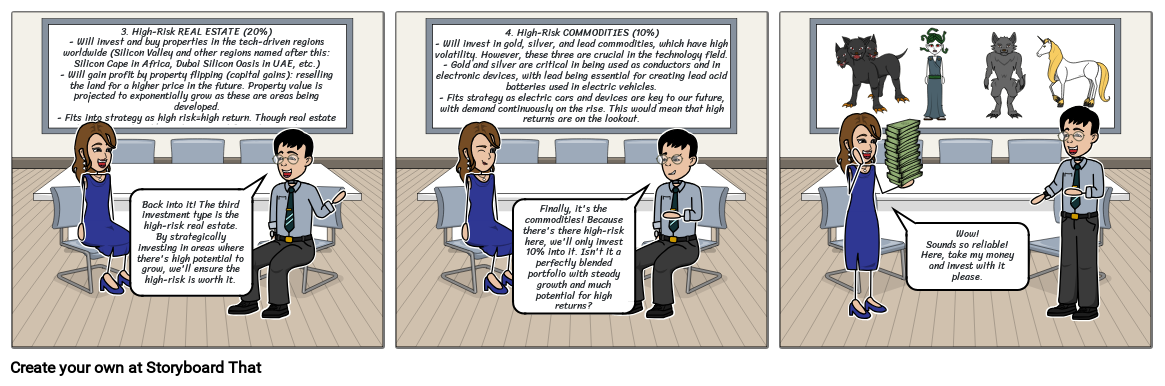

- 3. High-Risk REAL ESTATE (20%)- Will invest and buy properties in the tech-driven regions worldwide (Silicon Valley and other regions named after this: Silicon Cape in Africa, Dubai Silicon Oasis in UAE, etc.)- Will gain profit by property flipping (capital gains): reselling the land for a higher price in the future. Property value is projected to exponentially grow as these are areas being developed. - Fits into strategy as high risk=high return. Though real estate market is unpredictable, risk essential for substantial returns.

- Back into it! The third investment type is the high-risk real estate. By strategically investing in areas where there's high potential to grow, we'll ensure the high-risk is worth it.

- Slide: 2

- 4. High-Risk COMMODITIES (10%)- Will invest in gold, silver, and lead commodities, which have high volatility. However, these three are crucial in the technology field. - Gold and silver are critical in being used as conductors and in electronic devices, with lead being essential for creating lead acid batteries used in electric vehicles. - Fits strategy as electric cars and devices are key to our future, with demand continuously on the rise. This would mean that high returns are on the lookout.

- Finally, it's the commodities! Because there's there high-risk here, we'll only invest 10% into it. Isn't it a perfectly blended portfolio with steady growth and much potential for high returns?

- Slide: 3

- Wow! Sounds so reliable! Here, take my money and invest with it please.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!