credit hero

Storyboard Text

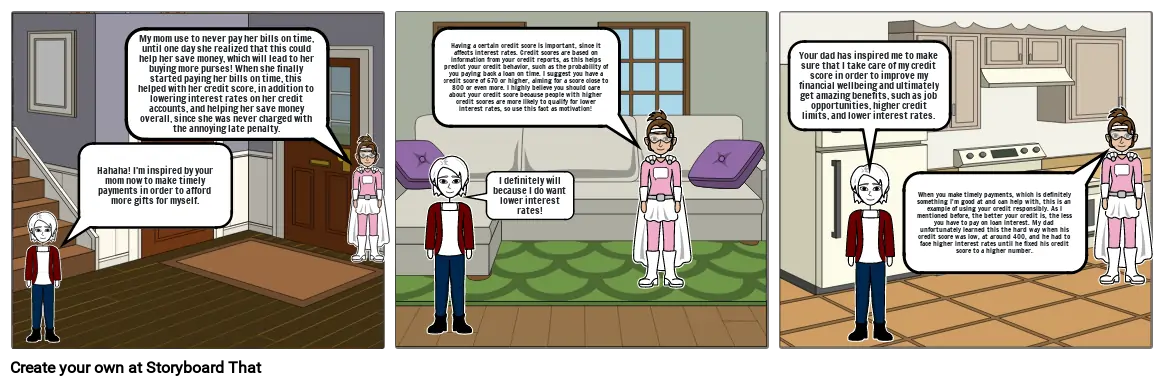

- Hahaha! I'm inspired by your mom now to make timely payments in order to afford more gifts for myself.

- My mom use to never pay her bills on time, until one day she realized that this could help her save money, which will lead to her buying more purses! When she finally started paying her bills on time, this helped with her credit score, in addition to lowering interest rates on her credit accounts, and helping her save money overall, since she was never charged with the annoying late penalty.

- Having a certain credit score is important, since it affects interest rates. Credit scores are based on information from your credit reports, as this helps predict your credit behavior, such as the probability of you paying back a loan on time. I suggest you have a credit score of 670 or higher, aiming for a score close to 800 or even more. I highly believe you should care about your credit score because people with higher credit scores are more likely to qualify for lower interest rates, so use this fact as motivation!

- I definitely will because I do want lower interest rates!

- Your dad has inspired me to make sure that I take care of my credit score in order to improve my financial wellbeing and ultimately get amazing benefits, such as job opportunities, higher credit limits, and lower interest rates.

- When you make timely payments, which is definitely something I'm good at and can help with, this is an example of using your credit responsibly. As I mentioned before, the better your credit is, the less you have to pay on loan interest. My dad unfortunately learned this the hard way when his credit score was low, at around 400, and he had to face higher interest rates until he fixed his credit score to a higher number.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!