Unknown Story

Storyboard Text

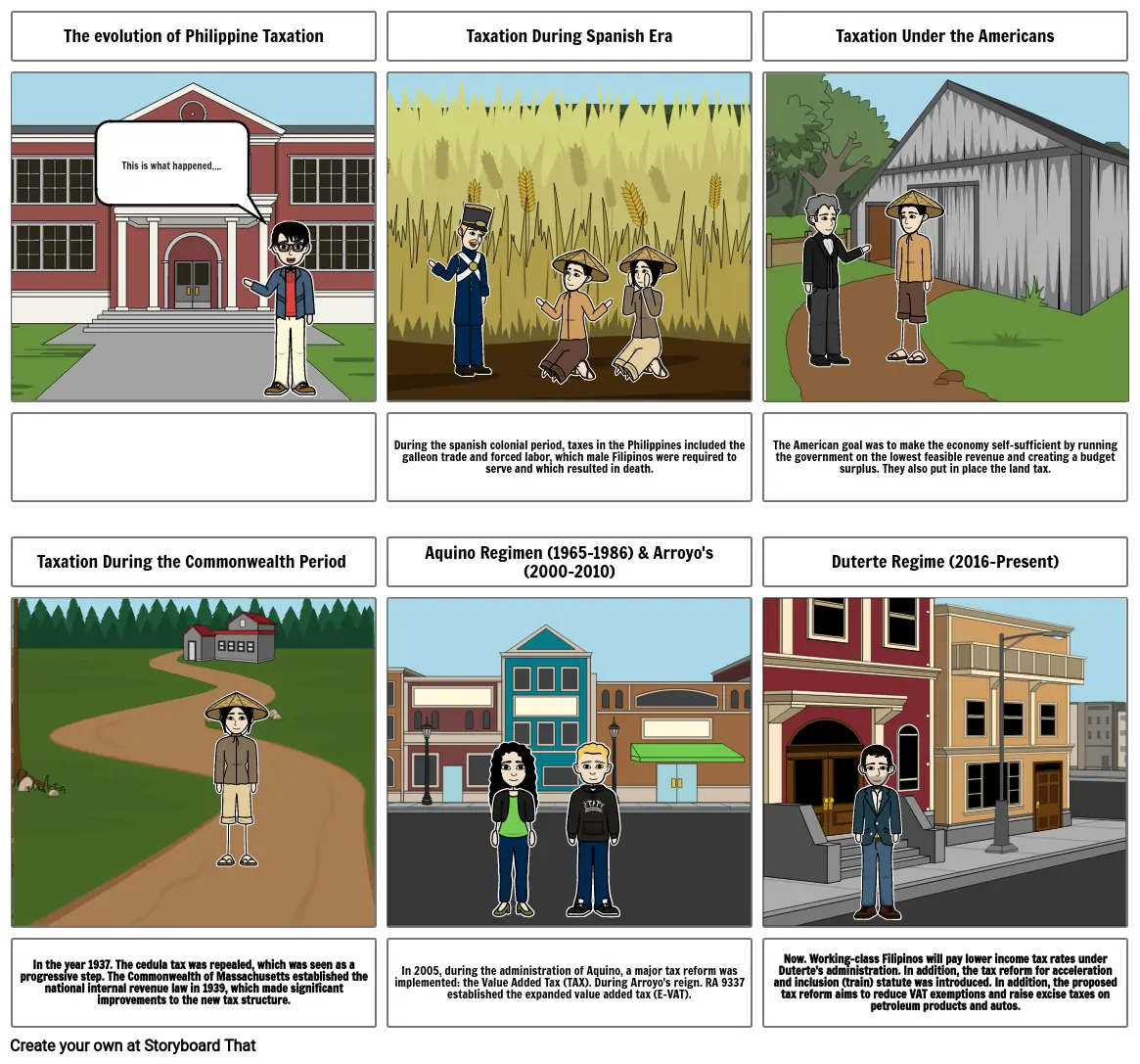

- The evolution of Philippine Taxation

- This is what happened....

- Taxation During Spanish Era

- Taxation Under the Americans

- Taxation During the Commonwealth Period

- During the spanish colonial period, taxes in the Philippines included the galleon trade and forced labor, which male Filipinos were required to serve and which resulted in death.

- Aquino Regimen (1965-1986) & Arroyo's (2000-2010)

- The American goal was to make the economy self-sufficient by running the government on the lowest feasible revenue and creating a budget surplus. They also put in place the land tax.

- Duterte Regime (2016-Present)

- In the year 1937. The cedula tax was repealed, which was seen as a progressive step. The Commonwealth of Massachusetts established the national internal revenue law in 1939, which made significant improvements to the new tax structure.

- In 2005, during the administration of Aquino, a major tax reform was implemented: the Value Added Tax (TAX). During Arroyo's reign. RA 9337 established the expanded value added tax (E-VAT).

- Now. Working-class Filipinos will pay lower income tax rates under Duterte's administration. In addition, the tax reform for acceleration and inclusion (train) statute was introduced. In addition, the proposed tax reform aims to reduce VAT exemptions and raise excise taxes on petroleum products and autos.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!