Unknown Story

Storyboard Text

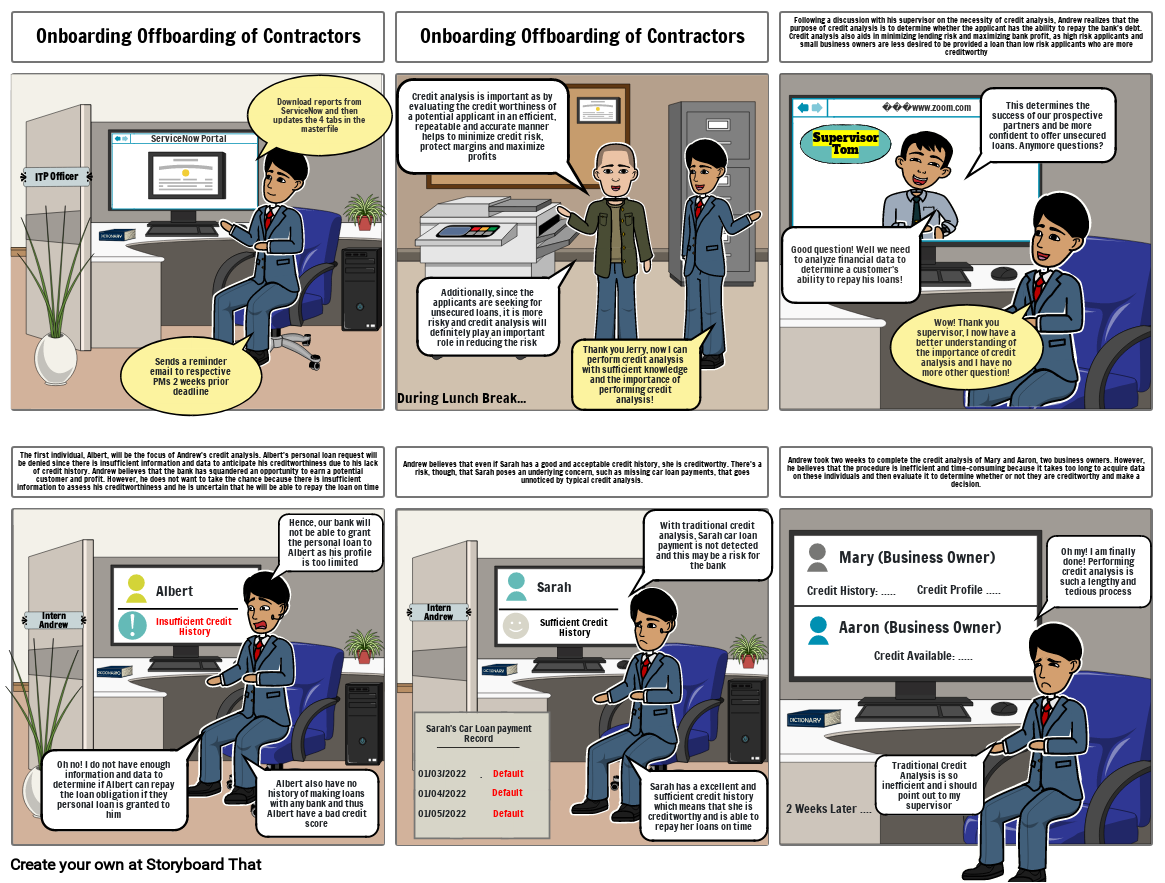

- Onboarding Offboarding of Contractors

- ITP Officer

- ServiceNow Portal

- Sends a reminder email to respective PMs 2 weeks prior deadline

- Download reports from ServiceNow and then updates the 4 tabs in the masterfile

- During Lunch Break...

- Onboarding Offboarding of Contractors

- Credit analysis is important as by evaluating the credit worthiness of a potential applicant in an efficient, repeatable and accurate manner helps to minimize credit risk, protect margins and maximize profits

- Additionally, since the applicants are seeking for unsecured loans, it is more risky and credit analysis will definitely play an important role in reducing the risk

- Thank you Jerry, now I can perform credit analysis with sufficient knowledge and the importance of performing credit analysis!

- Following a discussion with his supervisor on the necessity of credit analysis, Andrew realizes that the purpose of credit analysis is to determine whether the applicant has the ability to repay the bank's debt. Credit analysis also aids in minimizing lending risk and maximizing bank profit, as high risk applicants and small business owners are less desired to be provided a loan than low risk applicants who are more creditworthy

- Good question! Well we need to analyze financial data to determine a customer's ability to repay his loans!

- ���www.zoom.com

- Supervisor Tom

- Wow! Thank you supervisor, I now have a better understanding of the importance of credit analysis and I have no more other question!

- This determines the success of our prospective partners and be more confident to offer unsecured loans. Anymore questions?

- The first individual, Albert, will be the focus of Andrew's credit analysis. Albert's personal loan request will be denied since there is insufficient information and data to anticipate his creditworthiness due to his lack of credit history. Andrew believes that the bank has squandered an opportunity to earn a potential customer and profit. However, he does not want to take the chance because there is insufficient information to assess his creditworthiness and he is uncertain that he will be able to repay the loan on time

- Intern Andrew

- Albert

- Insufficient Credit History

- Hence, our bank will not be able to grant the personal loan to Albert as his profile is too limited

- Andrew believes that even if Sarah has a good and acceptable credit history, she is creditworthy. There's a risk, though, that Sarah poses an underlying concern, such as missing car loan payments, that goes unnoticed by typical credit analysis.

- Intern Andrew

- Sarah's Car Loan payment Record

- Sarah

- Sufficient Credit History

- With traditional credit analysis, Sarah car loan payment is not detected and this may be a risk for the bank

- Andrew took two weeks to complete the credit analysis of Mary and Aaron, two business owners. However, he believes that the procedure is inefficient and time-consuming because it takes too long to acquire data on these individuals and then evaluate it to determine whether or not they are creditworthy and make a decision.

- Credit History: .....

- Aaron (Business Owner)

- Mary (Business Owner)

- Credit Available: .....

- Credit Profile .....

- Oh my! I am finally done! Performing credit analysis is such a lengthy and tedious process

- Oh no! I do not have enough information and data to determine if Albert can repay the loan obligation if they personal loan is granted to him

- Albert also have no history of making loans with any bank and thus Albert have a bad credit score

- 01/04/2022

- 01/03/2022

- 01/05/2022

- .

- Default

- Default

- Default

- Sarah has a excellent and sufficient credit history which means that she is creditworthy and is able to repay her loans on time

- 2 Weeks Later ....

- Traditional Credit Analysis is so inefficient and i should point out to my supervisor

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!