Unknown Story

Storyboard Text

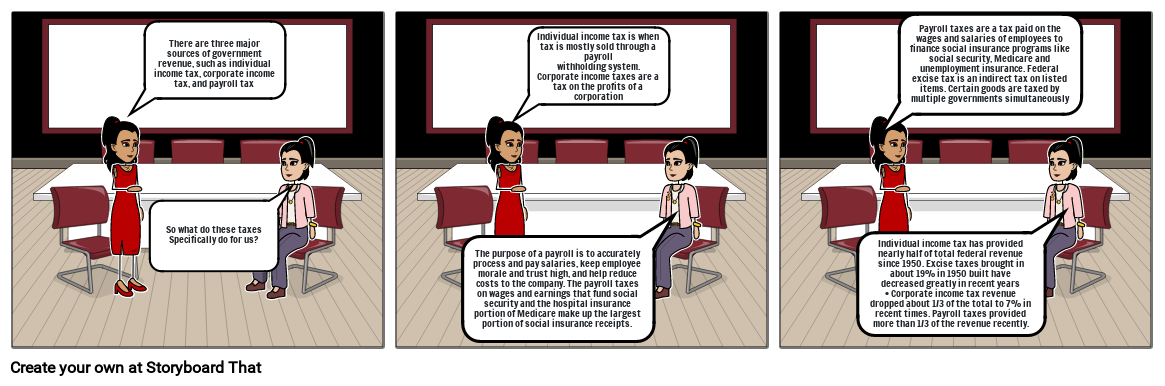

- There are three major sources of government revenue, such as individual income tax, corporate income tax, and payroll tax

- So what do these taxes Specifically do for us?

- The purpose of a payroll is to accurately process and pay salaries, keep employee morale and trust high, and help reduce costs to the company. The payroll taxes on wages and earnings that fund social security and the hospital insurance portion of Medicare make up the largest portion of social insurance receipts.

- Individual income tax is when tax is mostly sole Ted through a payrollwithholding system. Corporate income taxes are a tax on the profits of a corporation

- Individual income tax has provided nearly half of total federal revenue since 1950. Excise taxes brought in about 19% in 1950 built have decreased greatly in recent years• Corporate income tax revenue dropped about 1/3 of the total to 7% in recent times. Payroll taxes provided more than 1/3 of the revenue recently.

- Payroll taxes are a tax paid on the wages and salaries of employees tofinance social insurance programs like social security, Medicare and unemployment insurance. Federal excise tax is an indirect tax on listed items. Certain goods are taxed by multiple governments simultaneously

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!