example

Storyboard Text

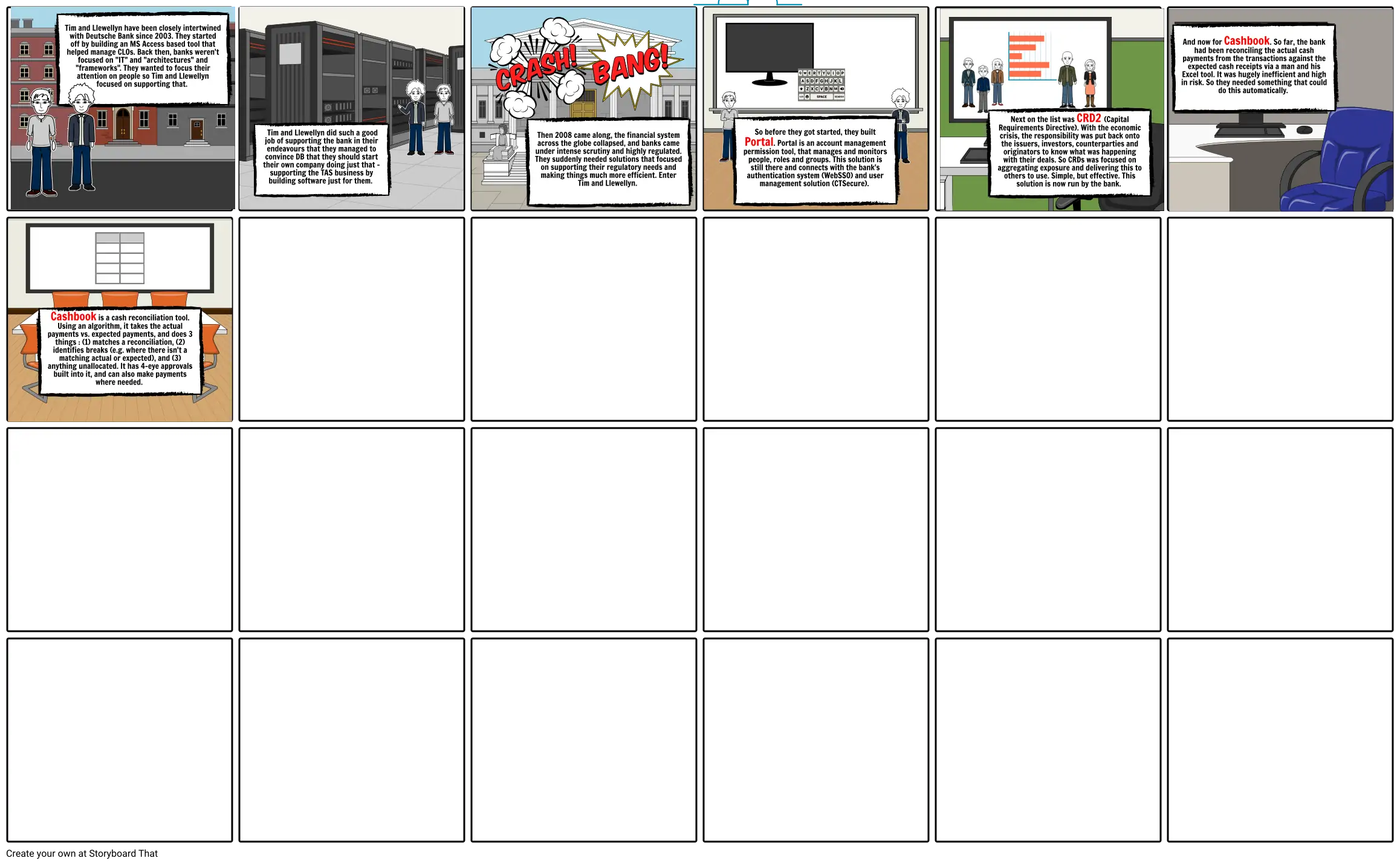

- Tim and Llewellyn have been closely intertwined with Deutsche Bank since 2003. They started off by building an MS Access based tool that helped manage CLOs. Back then, banks weren't focused on "IT" and "architectures" and "frameworks". They wanted to focus their attention on people so Tim and Llewellyn focused on supporting that.

- Tim and Llewellyn did such a good job of supporting the bank in their endeavours that they managed to convince DB that they should start their own company doing just that - supporting the TAS business by building software just for them.

- Then 2008 came along, the financial system across the globe collapsed, and banks came under intense scrutiny and highly regulated. They suddenly needed solutions that focused on supporting their regulatory needs and making things much more efficient. Enter Tim and Llewellyn.

- So before they got started, they built Portal. Portal is an account management permission tool, that manages and monitors people, roles and groups. This solution is still there and connects with the bank's authentication system (WebSSO) and user management solution (CTSecure).

- Next on the list was CRD2 (Capital Requirements Directive). With the economic crisis, the responsibility was put back onto the issuers, investors, counterparties and originators to know what was happening with their deals. So CRDs was focused on aggregating exposure and delivering this to others to use. Simple, but effective. This solution is now run by the bank.

- And now for Cashbook. So far, the bank had been reconciling the actual cash payments from the transactions against the expected cash receipts via a man and his Excel tool. It was hugely inefficient and high in risk. So they needed something that could do this automatically.

- Cashbook is a cash reconciliation tool. Using an algorithm, it takes the actual payments vs. expected payments, and does 3 things : (1) matches a reconciliation, (2) identifies breaks (e.g. where there isn't a matching actual or expected), and (3) anything unallocated. It has 4-eye approvals built into it, and can also make payments where needed.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!