Unknown Story

Storyboard Text

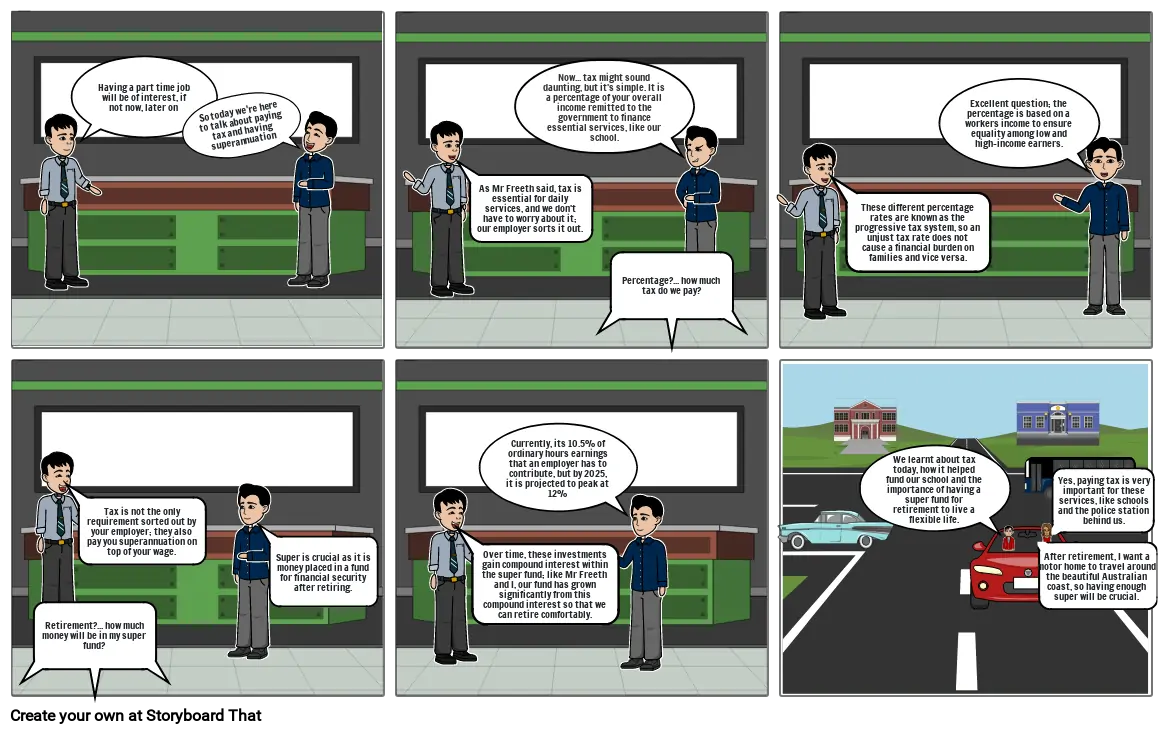

- Having a part time job will be of interest, if not now, later on

- So today we're here to talk about paying tax and having superannuation

- As Mr Freeth said, tax is essential for daily services, and we don't have to worry about it; our employer sorts it out.

- Now... tax might sound daunting, but it's simple. It is a percentage of your overall income remitted to the government to finance essential services, like our school.

- Percentage?... how much tax do we pay?

- These different percentage rates are known as the progressive tax system, so an unjust tax rate does not cause a financial burden on families and vice versa.

- Excellent question; the percentage is based on a workers income to ensure equality among low and high-income earners.

- Retirement?... how much money will be in my super fund?

- Tax is not the only requirement sorted out by your employer; they also pay you superannuation on top of your wage.

- Super is crucial as it is money placed in a fund for financial security after retiring.

- Over time, these investments gain compound interest within the super fund; like Mr Freeth and I, our fund has grown significantly from this compound interest so that we can retire comfortably.

- Currently, its 10.5% of ordinary hours earnings that an employer has to contribute, but by 2025, it is projected to peak at 12%

- We learnt about tax today, how it helped fund our school and the importance of having a super fund for retirement to live a flexible life.

- After retirement, I want a motor home to travel around the beautiful Australian coast, so having enough super will be crucial.

- Yes, paying tax is very important for these services, like schools and the police station behind us.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!