Inflation

Storyboard Text

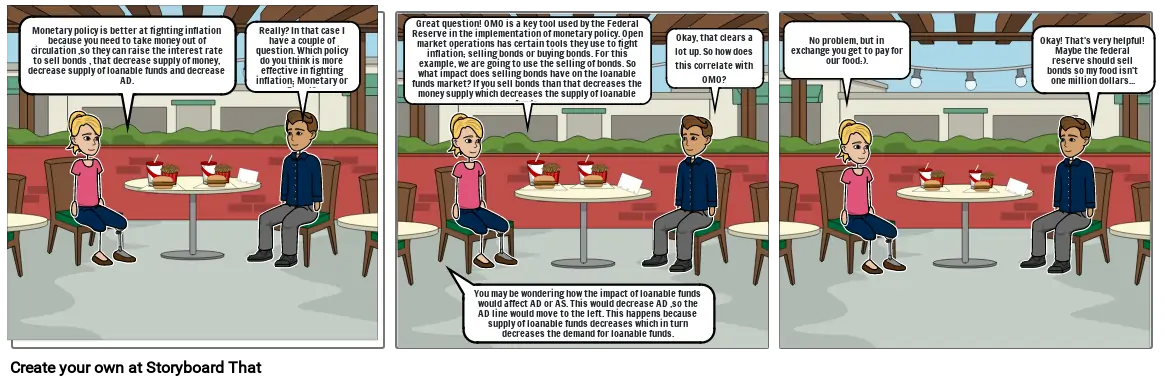

- Monetary policy is better at fighting inflation because you need to take money out of circulation ,so they can raise the interest rate to sell bonds , that decrease supply of money, decrease supply of loanable funds and decrease AD.

- Really? In that case I have a couple of question. Which policy do you think is more effective in fighting inflation; Monetary or Fiscal?

- Great question! OMO is a key tool used by the Federal Reserve in the implementation of monetary policy. Open market operations has certain tools they use to fight inflation; selling bonds or buying bonds. For this example, we are going to use the selling of bonds. So what impact does selling bonds have on the loanable funds market? If you sell bonds than that decreases the money supply which decreases the supply of loanable funds.

- You may be wondering how the impact of loanable funds would affect AD or AS. This would decrease AD ,so the AD line would move to the left. This happens because supply of loanable funds decreases which in turn decreases the demand for loanable funds.

- Okay, that clears a lot up. So how does this correlate with OMO?

- No problem, but in exchange you get to pay for our food:).

- Okay! That's very helpful! Maybe the federal reserve should sell bonds so my food isn't one million dollars...

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!