Unknown Story

Storyboard Text

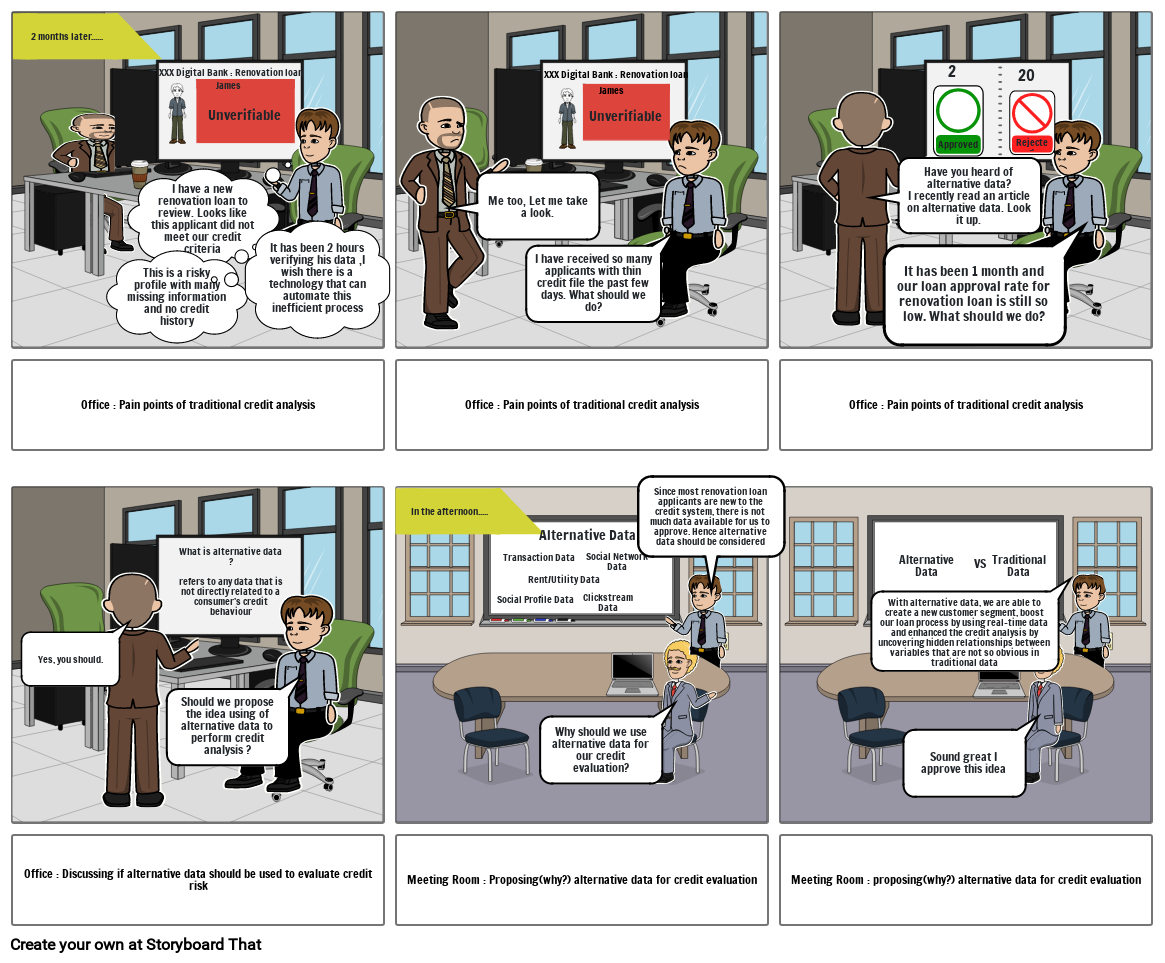

- 2 months later......

- This is a risky profile with many missing information and no credit history

- I have a new renovation loan to review. Looks like this applicant did not meet our credit criteria

- XXX Digital Bank : Renovation loan

- James Unverifiable

- It has been 2 hours verifying his data ,I wish there is a technology that can automate this inefficient process

- Me too, Let me take a look.

- XXX Digital Bank : Renovation loan

- I have received so many applicants with thin credit file the past few days. What should we do?

- James Unverifiable

- Have you heard of alternative data?I recently read an article on alternative data. Look it up.

- It has been 1 month and our loan approval rate for renovation loan is still so low. What should we do?

- 2

- Approved

- 20

- Rejected

- Office : Pain points of traditional credit analysis

- Yes, you should.

- Should we propose the idea using of alternative data to perform credit analysis ?

- What is alternative data ?refers to any data that is not directly related to a consumer’s credit behaviour

- In the afternoon.....

- Office : Pain points of traditional credit analysis

- Social Profile Data

- Transaction Data

- Rent/Utility Data

- Alternative Data

- Clickstream Data

- Social Network Data

- Since most renovation loan applicants are new to the credit system, there is not much data available for us to approve. Hence alternative data should be considered

- Office : Pain points of traditional credit analysis

- With alternative data, we are able to create a new customer segment, boost our loan process by using real-time data and enhanced the credit analysis by uncovering hidden relationships between variables that are not so obvious in traditional data

- Alternative Data

- VS

- Traditional Data

- Office : Discussing if alternative data should be used to evaluate credit risk

- Meeting Room : Proposing(why?) alternative data for credit evaluation

- Why should we use alternative data for our credit evaluation?

- Meeting Room : proposing(why?) alternative data for credit evaluation

- Sound great I approve this idea

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!