Unknown Story

Storyboard Text

- MV MV MV MV MV MV MV MV MV MV MV MV MV MV

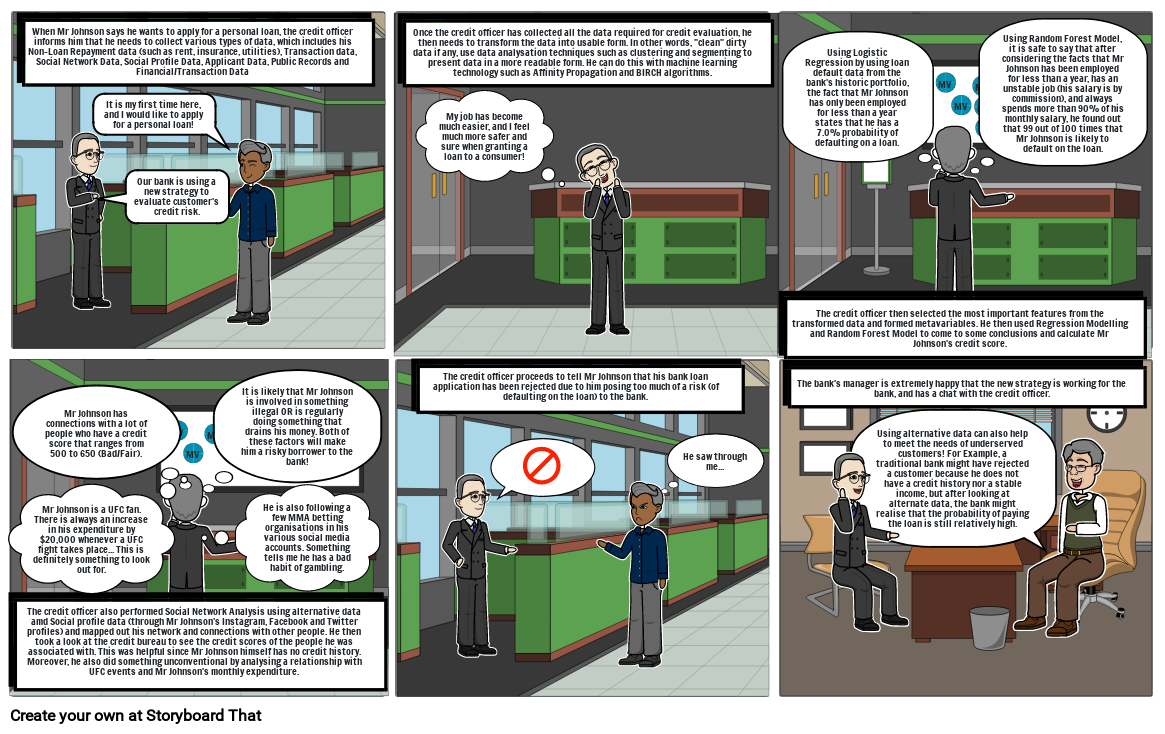

- When Mr Johnson says he wants to apply for a personal loan, the credit officer informs him that he needs to collect various types of data, which includes his Non-Loan Repayment data (such as rent, insurance, utilities), Transaction data, Social Network Data, Social Profile Data, Applicant Data, Public Records and Financial/Transaction Data

- Our bank is using a new strategy to evaluate customer's credit risk.

- It is my first time here, and I would like to apply for a personal loan!

- Once the credit officer has collected all the data required for credit evaluation, he then needs to transform the data into usable form. In other words, clean dirty data if any, use data analysation techniques such as clustering and segmenting to present data in a more readable form. He can do this with machine learning technology such as Affinity Propagation and BIRCH algorithms.

- My job has become much easier, and I feel much more safer and sure when granting a loan to a consumer!

- The credit officer then selected the most important features from the transformed data and formed metavariables. He then used Regression Modelling and Random Forest Model to come to some conclusions and calculate Mr Johnson's credit score.

- Using Logistic Regression by using loan default data from the bank's historic portfolio, the fact that Mr Johnson has only been employed for less than a year states that he has a 7.0% probability of defaulting on a loan.

- Using Random Forest Model, it is safe to say that after considering the facts that Mr Johnson has been employed for less than a year, has an unstable job (his salary is by commission), and always spends more than 90% of his monthly salary, he found out that 99 out of 100 times that Mr Johnson is likely to default on the loan.

- Mr Johnson is a UFC fan. There is always an increase in his expenditure by $20,000 whenever a UFC fight takes place... This is definitely something to look out for.

- The credit officer also performed Social Network Analysis using alternative data amd Social profile data (through Mr Johnson's Instagram, Facebook and Twitter profiles) and mapped out his network and connections with other people. He then took a look at the credit bureau to see the credit scores of the people he was associated with. This was helpful since Mr Johnson himself has no credit history. Moreover, he also did something unconventional by analysing a relationship with UFC events and Mr Johnson's monthly expenditure.

- Mr Johnson has connections with a lot of people who have a credit score that ranges from 500 to 650 (Bad/Fair).

- He is also following a few MMA betting organisations in his various social media accounts. Something tells me he has a bad habit of gambling.

- It is likely that Mr Johnson is involved in something illegal OR is regularly doing something that drains his money. Both of these factors will make him a risky borrower to the bank!

- The credit officer proceeds to tell Mr Johnson that his bank loan application has been rejected due to him posing too much of a risk (of defaulting on the loan) to the bank.

-

- He saw through me...

- The bank's manager is extremely happy that the new strategy is working for the bank, and has a chat with the credit officer.

- Using alternative data can also help to meet the needs of underserved customers! For Example, a traditional bank might have rejected a customer because he does not have a credit history nor a stable income, but after looking at alternate data, the bank might realise that the probability of paying the loan is still relatively high.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!