Inflation Story

Storyboard Text

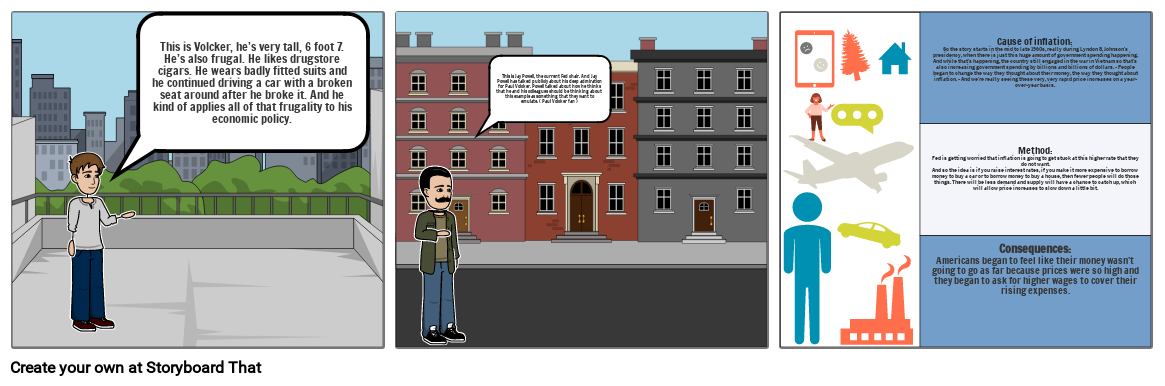

- This is Volcker, he’s very tall, 6 foot 7. He’s also frugal. He likes drugstore cigars. He wears badly fitted suits and he continued driving a car with a broken seat around after he broke it. And he kind of applies all of that frugality to his economic policy.

- This is Jay Powell, the current Fed chair. And Jay Powell has talked publicly about his deep admiration for Paul Volcker. Powell talked about how he thinks that he and his colleagues should be thinking about this example as something that they want to emulate. ( Paul Volcker fan )

- Cause of inflation:So the story starts in the mid to late 1960s, really during Lyndon B. Johnson’s presidency, when there is just this huge amount of government spending happening. And while that’s happening, the country still engaged in the war in Vietnam so that’s also increasing government spending by billions and billions of dollars. - People began to change the way they thought about their money, the way they thought about inflation. - And we’re really seeing these very, very rapid price increases on a year-over-year basis. Method:Fed is getting worried that inflation is going to get stuck at this higher rate that they do not want.And so the idea is if you raise interest rates, if you make it more expensive to borrow money to buy a car or to borrow money to buy a house, then fewer people will do those things. There will be less demand and supply will have a chance to catch up, which will allow price increases to slow down a little bit. Consequences:Americans began to feel like their money wasn’t going to go as far because prices were so high and they began to ask for higher wages to cover their rising expenses.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!