Savings

Storyboard Text

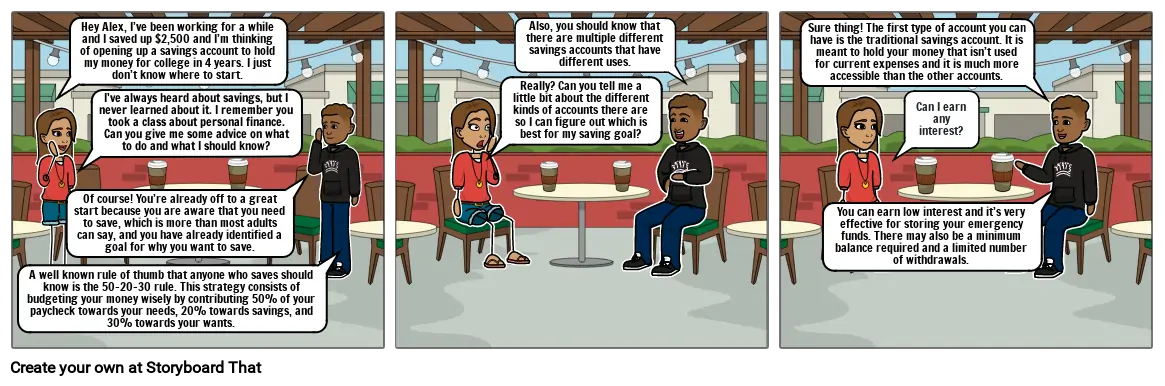

- A well known rule of thumb that anyone who saves should know is the 50-20-30 rule. This strategy consists of budgeting your money wisely by contributing 50% of your paycheck towards your needs, 20% towards savings, and 30% towards your wants.

- Hey Alex, I’ve been working for a while and I saved up $2,500 and I’m thinking of opening up a savings account to hold my money for college in 4 years. I just don’t know where to start.

- Of course! You’re already off to a great start because you are aware that you need to save, which is more than most adults can say, and you have already identified a goal for why you want to save.

- I’ve always heard about savings, but I never learned about it. I remember you took a class about personal finance. Can you give me some advice on what to do and what I should know?

- Really? Can you tell me a little bit about the different kinds of accounts there are so I can figure out which is best for my saving goal?

- Also, you should know that there are multiple different savings accounts that have different uses.

- Sure thing! The first type of account you can have is the traditional savings account. It is meant to hold your money that isn’t used for current expenses and it is much more accessible than the other accounts.

- You can earn low interest and it’s very effective for storing your emergency funds. There may also be a minimum balance required and a limited number of withdrawals.

- Can I earn any interest?

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!