Savings 2

Storyboard Text

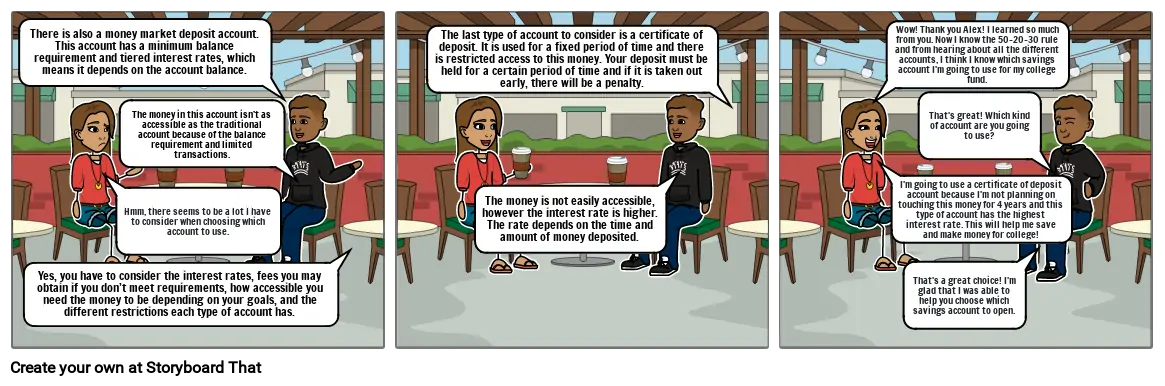

- There is also a money market deposit account. This account has a minimum balance requirement and tiered interest rates, which means it depends on the account balance.

- Yes, you have to consider the interest rates, fees you may obtain if you don’t meet requirements, how accessible you need the money to be depending on your goals, and the different restrictions each type of account has.

- Hmm, there seems to be a lot I have to consider when choosing which account to use.

- The money in this account isn’t as accessible as the traditional account because of the balance requirement and limited transactions.

- The last type of account to consider is a certificate of deposit. It is used for a fixed period of time and there is restricted access to this money. Your deposit must be held for a certain period of time and if it is taken out early, there will be a penalty.

- The money is not easily accessible, however the interest rate is higher. The rate depends on the time and amount of money deposited.

- Wow! Thank you Alex! I learned so much from you. Now I know the 50-20-30 rule and from hearing about all the different accounts, I think I know which savings account I'm going to use for my college fund.

- I'm going to use a certificate of deposit account because I'm not planning on touching this money for 4 years and this type of account has the highest interest rate. This will help me save and make money for college!

- That's a great choice! I'm glad that I was able to help you choose which savings account to open.

- That's great! Which kind of account are you going to use?

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!