Identity Theft

Storyboard Text

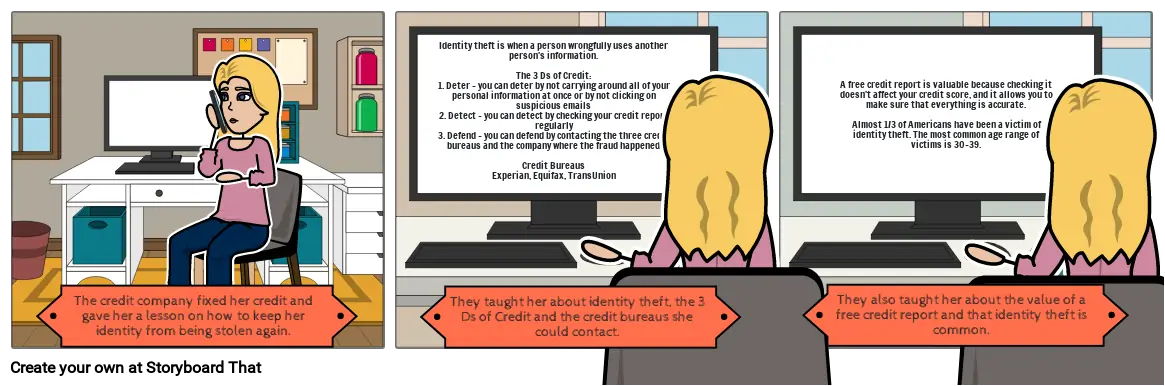

- The credit company fixed her credit and gave her a lesson on how to keep her identity from being stolen again.

- They taught her about identity theft, the 3 Ds of Credit and the credit bureaus she could contact.

- Identity theft is when a person wrongfully uses another person's information.The 3 Ds of Credit:1. Deter - you can deter by not carrying around all of your personal information at once or by not clicking on suspicious emails2. Detect - you can detect by checking your credit report regularly3. Defend - you can defend by contacting the three credit bureaus and the company where the fraud happenedCredit BureausExperian, Equifax, TransUnion

- They also taught her about the value of a free credit report and that identity theft is common.

- A free credit report is valuable because checking it doesn't affect your credit score, and it allows you to make sure that everything is accurate.Almost 1/3 of Americans have been a victim of identity theft. The most common age range of victims is 30-39.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!