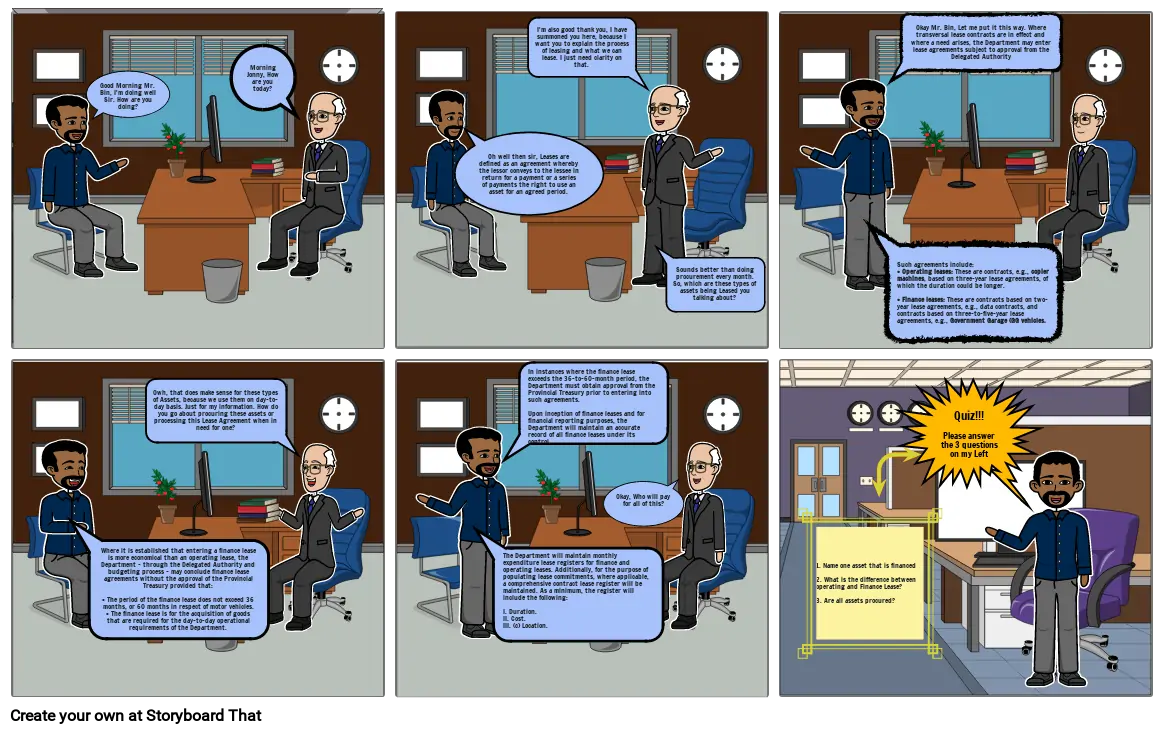

Unknown Story

Storyboard Text

- Good Morning Mr. Bin, I'm doing well Sir. How are you doing?

- Morning Jonny, How are you today?

- Oh well then sir, Leases are defined as an agreement whereby the lessor conveys to the lessee in return for a payment or a series of payments the right to use an asset for an agreed period.

- I'm also good thank you, I have summoned you here, because I want you to explain the process of leasing and what we can lease. I just need clarity on that.

- Sounds better than doing procurement every month. So, which are these types of assets being Leased you talking about?

- Such agreements include: • Operating leases: These are contracts, e.g., copier machines, based on three-year lease agreements, of which the duration could be longer.• Finance leases: These are contracts based on two-year lease agreements, e.g., data contracts, and contracts based on three-to-five-year lease agreements, e.g., Government Garage (GG vehicles.

- Okay Mr. Bin, Let me put it this way. Where transversal lease contracts are in effect and where a need arises, the Department may enter lease agreements subject to approval from the Delegated Authority

- Where it is established that entering a finance lease is more economical than an operating lease, the Department - through the Delegated Authority and budgeting process - may conclude finance lease agreements without the approval of the Provincial Treasury provided that: • The period of the finance lease does not exceed 36 months, or 60 months in respect of motor vehicles. • The finance lease is for the acquisition of goods that are required for the day-to-day operational requirements of the Department.

- Owh, that does make sense for these types of Assets, because we use them on day-to-day basis. Just for my information. How do you go about procuring these assets or processing this Lease Agreement when in need for one?

- The Department will maintain monthly expenditure lease registers for finance and operating leases. Additionally, for the purpose of populating lease commitments, where applicable, a comprehensive contract lease register will be maintained. As a minimum, the register will include the following:I. Duration.II. Cost.III. (c) Location.

- In instances where the finance lease exceeds the 36-to-60-month period, the Department must obtain approval from the Provincial Treasury prior to entering into such agreements. Upon inception of finance leases and for financial reporting purposes, the Department will maintain an accurate record of all finance leases under its control.

- Okay, Who will pay for all of this?

- 1. Name one asset that is financed 2. What is the difference between operating and Finance Lease? 3. Are all assets procured?

- Quiz!!!Please answer the 3 questions on my Left

Over 30 Million Storyboards Created