taxation

Storyboard Text

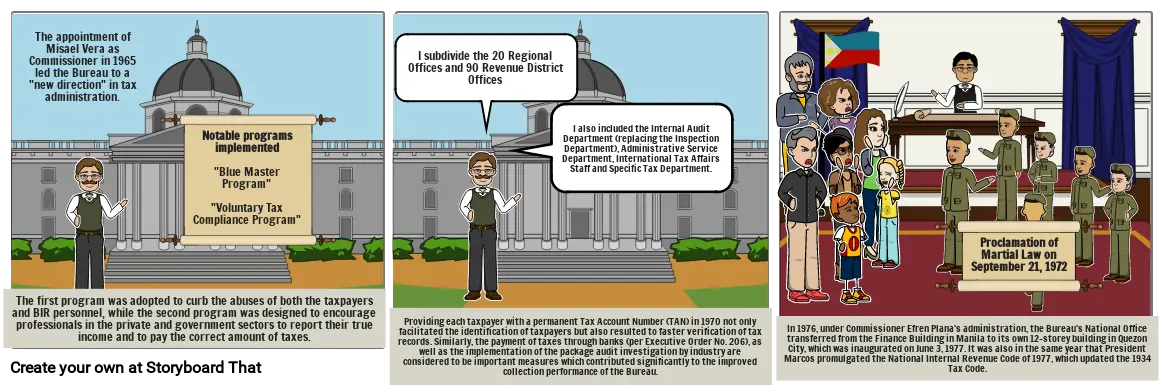

- The first program was adopted to curb the abuses of both the taxpayers and BIR personnel, while the second program was designed to encourage professionals in the private and government sectors to report their true income and to pay the correct amount of taxes.

- The appointment of Misael Vera as Commissioner in 1965 led the Bureau to a "new direction" in tax administration.

- Notable programs implemented"Blue Master Program""Voluntary Tax Compliance Program"

- Providing each taxpayer with a permanent Tax Account Number (TAN) in 1970 not only facilitated the identification of taxpayers but also resulted to faster verification of tax records. Similarly, the payment of taxes through banks (per Executive Order No. 206), as well as the implementation of the package audit investigation by industry are considered to be important measures which contributed significantly to the improved collection performance of the Bureau.

- I subdivide the 20 Regional Offices and 90 Revenue District Offices

- I also included the Internal Audit Department (replacing the Inspection Department), Administrative Service Department, International Tax Affairs Staff and Specific Tax Department.

- In 1976, under Commissioner Efren Plana's administration, the Bureau's National Office transferred from the Finance Building in Manila to its own 12-storey building in Quezon City, which was inaugurated on June 3, 1977. It was also in the same year that President Marcos promulgated the National Internal Revenue Code of 1977, which updated the 1934 Tax Code.

- Proclamation of Martial Law on September 21, 1972

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!