Banking?

Storyboard Text

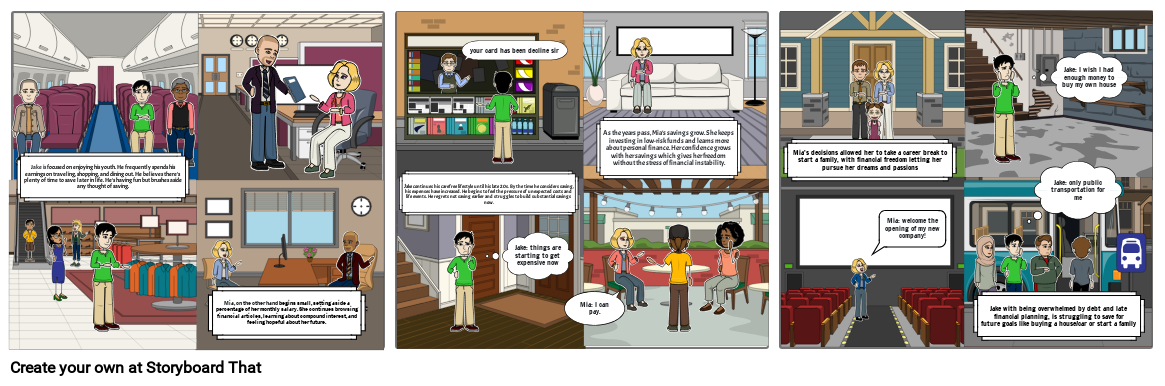

- Slide: 1

- Jake is focused on enjoying his youth. He frequently spends his earnings on traveling, shopping, and dining out. He believes there’s plenty of time to save later in life. He’s having fun but brushes aside any thought of saving.

- Mia, on the other hand begins small, setting aside a percentage of her monthly salary. She continues browsing financial articles, learning about compound interest, and feeling hopeful about her future.

- Slide: 2

- your card has been decline sir

- As the years pass, Mia’s savings grow. She keeps investing in low-risk funds and learns more about personal finance. Her confidence grows with her savings which gives her freedom without the stress of financial instability.

- Jake continues his carefree lifestyle until his late 20s. By the time he considers saving, his expenses have increased. He begins to feel the pressure of unexpected costs and life events. He regrets not saving earlier and struggles to build substantial savings now.

- Jake: things are starting to get expensive now

- Mia: I can pay.

- Slide: 3

- Jake: I wish I had enough money to buy my own house

- Mia’s decisions allowed her to take a career break to start a family, with financial freedom letting her pursue her dreams and passions

- Jake: only public transportation for me

- Mia: welcome the opening of my new company!

- Jake with being overwhelmed by debt and late financial planning, is struggling to save for future goals like buying a house/car or start a family

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!