Unknown Story

Storyboard Text

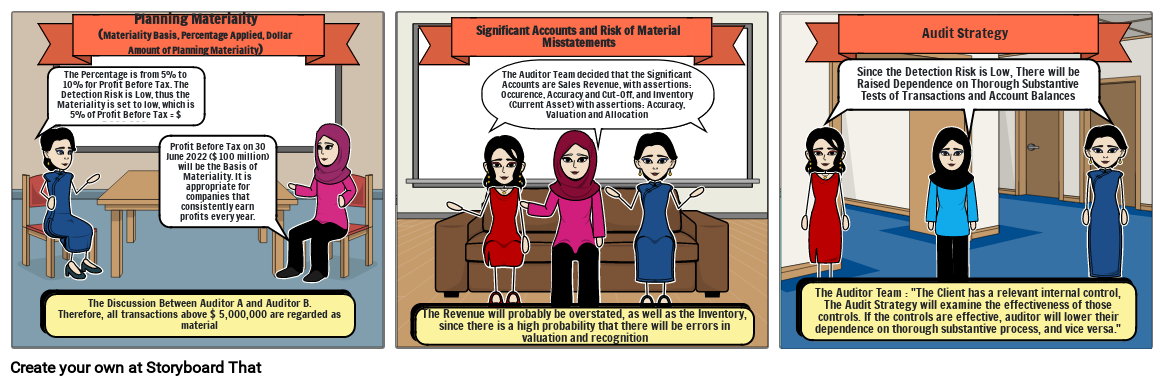

- The Percentage is from 5% to 10% for Profit Before Tax. The Detection Risk is Low, thus the Materiality is set to low, which is 5% of Profit Before Tax = $ 5,000,000.

- Planning Materiality (Materiality Basis, Percentage Applied, Dollar Amount of Planning Materiality)

- The Discussion Between Auditor A and Auditor B.Therefore, all transactions above $ 5,000,000 are regarded as material

- Profit Before Tax on 30 June 2022 ($ 100 million) will be the Basis of Materiality. It is appropriate for companies that consistently earn profits every year.

- The Revenue will probably be overstated, as well as the Inventory, since there is a high probability that there will be errors in valuation and recognition

- Significant Accounts and Risk of Material Misstatements

- The Auditor Team decided that the Significant Accounts are Sales Revenue, with assertions: Occurence, Accuracy and Cut-Off, and Inventory (Current Asset) with assertions: Accuracy, Valuation and Allocation

- The Auditor Team : The Client has a relevant internal control, The Audit Strategy will examine the effectiveness of those controls. If the controls are effective, auditor will lower their dependence on thorough substantive process, and vice versa.

- Audit Strategy

- Since the Detection Risk is Low, There will be Raised Dependence on Thorough Substantive Tests of Transactions and Account Balances

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!