Storyboard I

Storyboard Text

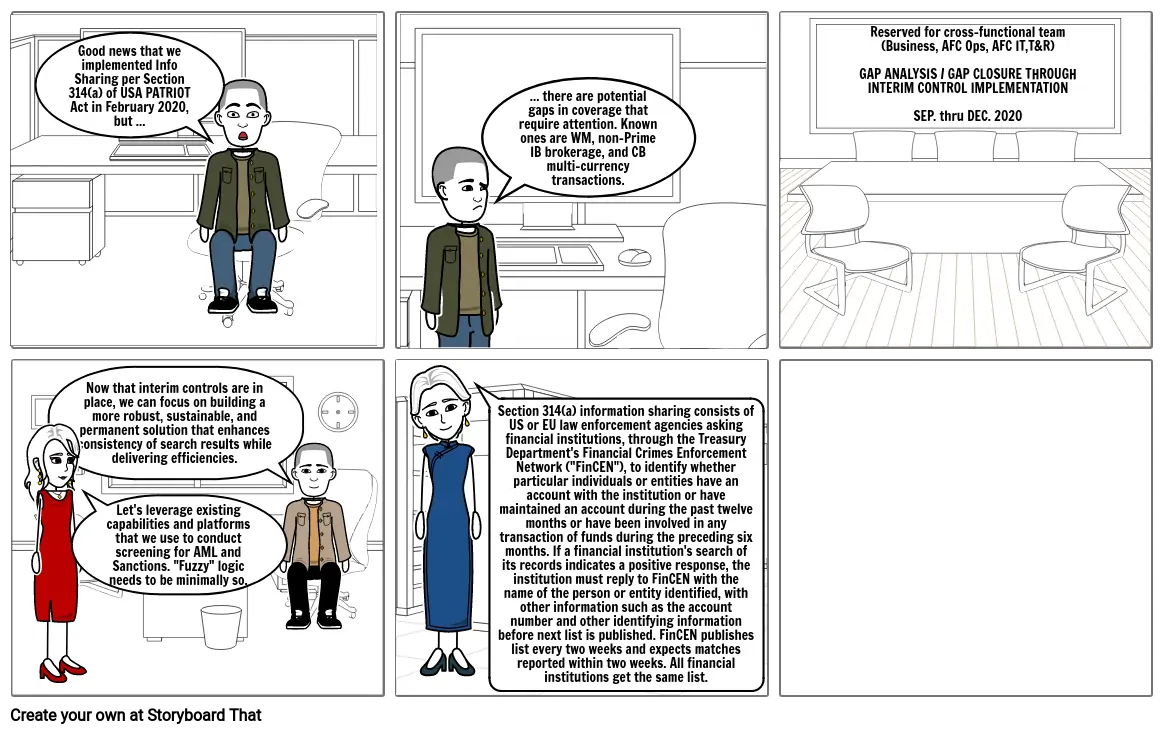

- Good news that we implemented Info Sharing per Section 314(a) of USA PATRIOT Act in February 2020, but ...

- ... there are potential gaps in coverage that require attention. Known ones are WM, non-Prime IB brokerage, and CB multi-currency transactions.

- Reserved for cross-functional team (Business, AFC Ops, AFC IT,T&R)GAP ANALYSIS / GAP CLOSURE THROUGH INTERIM CONTROL IMPLEMENTATIONSEP. thru DEC. 2020

- Now that interim controls are in place, we can focus on building a more robust, sustainable, and permanent solution that enhances consistency of search results while delivering efficiencies.

- Let's leverage existing capabilities and platforms that we use to conduct screening for AML and Sanctions. "Fuzzy" logic needs to be minimally so.

- Section 314(a) information sharing consists of US or EU law enforcement agencies asking financial institutions, through the Treasury Department's Financial Crimes Enforcement Network ("FinCEN"), to identify whether particular individuals or entities have an account with the institution or have maintained an account during the past twelve months or have been involved in any transaction of funds during the preceding six months. If a financial institution's search of its records indicates a positive response, the institution must reply to FinCEN with the name of the person or entity identified, with other information such as the account number and other identifying information before next list is published. FinCEN publishes list every two weeks and expects matches reported within two weeks. All financial institutions get the same list.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!