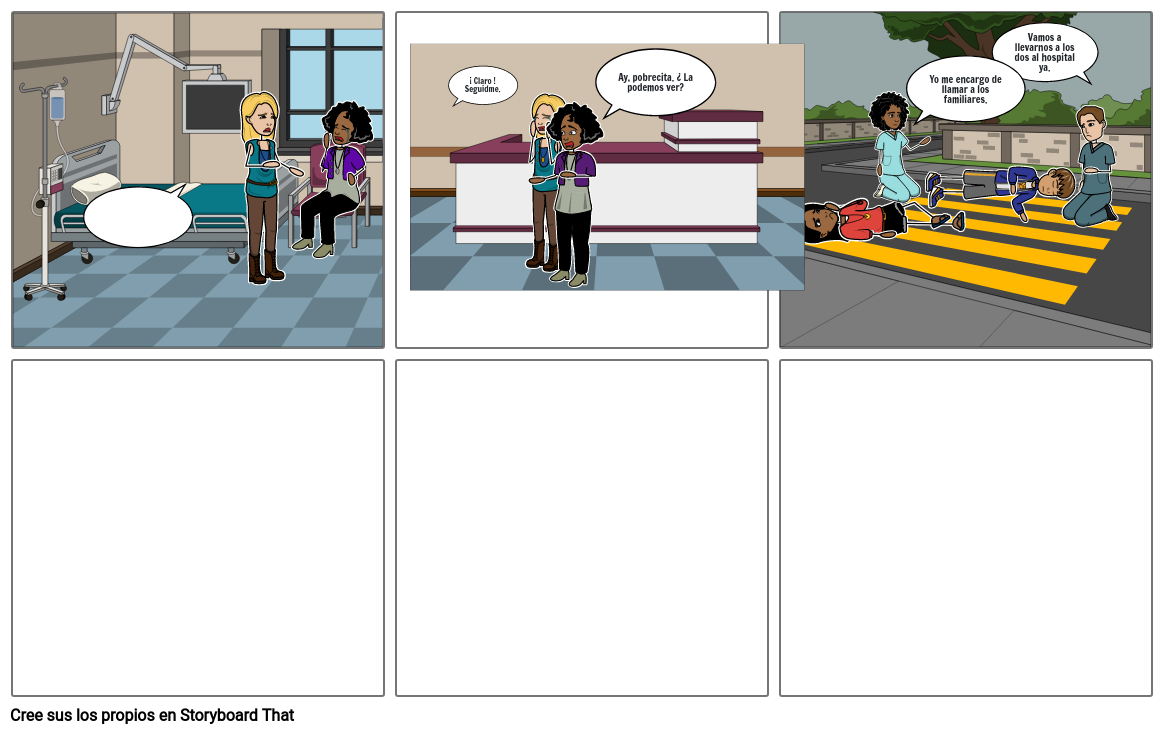

Unknown Story

Storyboard Text

- Tenemos que tranquilizarnos y esperar que dicen de las pruebas.

- ¡ Claro !Seguidme.

- Ay, pobrecita. ¿ La podemos ver?

- Yo me encargo de llamar a los familiares.

- Vamos a llevarnos a los dos al hospital ya.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!