Fiscal--Monetary

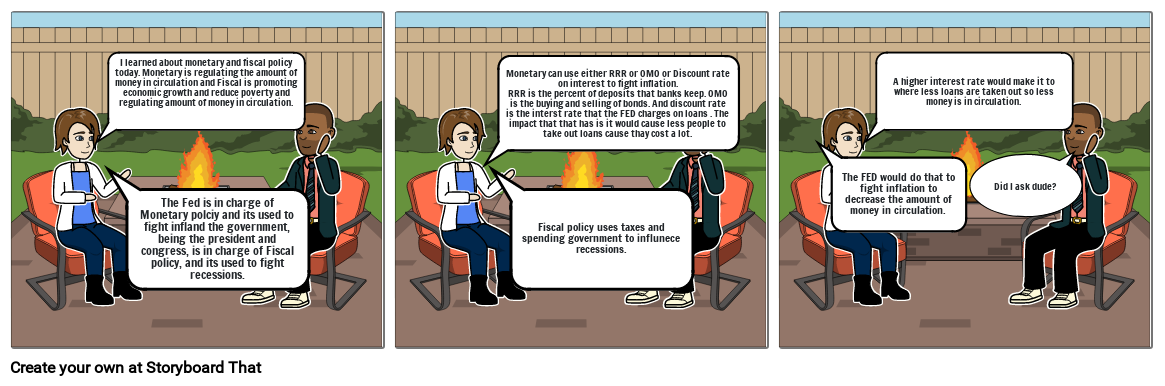

I learned about monetary and fiscal policy today. Monetary is regulating the amount of money in circulation and Fiscal is promoting economic growth and reduce poverty and regulating amount of money in circulation.

The Fed is in charge of Monetary polciy and its used to fight infland the government, being the president and congress, is in charge of Fiscal policy, and its used to fight recessions.

Monetary can use either RRR or OMO or Discount rate on interest to fight inflation.

RRR is the percent of deposits that banks keep. OMO is the buying and selling of bonds. And discount rate is the interst rate that the FED charges on loans . The impact that that has is it would cause less people to take out loans cause thay cost a lot.

Fiscal policy uses taxes and spending government to influnece recessions.

A higher interest rate would make it to where less loans are taken out so less money is in circulation.

The FED would do that to fight inflation to decrease the amount of money in circulation.

Did I ask dude?

I learned about monetary and fiscal policy today. Monetary is regulating the amount of money in circulation and Fiscal is promoting economic growth and reduce poverty and regulating amount of money in circulation.

The Fed is in charge of Monetary polciy and its used to fight infland the government, being the president and congress, is in charge of Fiscal policy, and its used to fight recessions.

Monetary can use either RRR or OMO or Discount rate on interest to fight inflation.

RRR is the percent of deposits that banks keep. OMO is the buying and selling of bonds. And discount rate is the interst rate that the FED charges on loans . The impact that that has is it would cause less people to take out loans cause thay cost a lot.

Fiscal policy uses taxes and spending government to influnece recessions.

A higher interest rate would make it to where less loans are taken out so less money is in circulation.

The FED would do that to fight inflation to decrease the amount of money in circulation.

Did I ask dude?

I learned about monetary and fiscal policy today. Monetary is regulating the amount of money in circulation and Fiscal is promoting economic growth and reduce poverty and regulating amount of money in circulation.

The Fed is in charge of Monetary polciy and its used to fight infland the government, being the president and congress, is in charge of Fiscal policy, and its used to fight recessions.

Monetary can use either RRR or OMO or Discount rate on interest to fight inflation.

RRR is the percent of deposits that banks keep. OMO is the buying and selling of bonds. And discount rate is the interst rate that the FED charges on loans . The impact that that has is it would cause less people to take out loans cause thay cost a lot.

Fiscal policy uses taxes and spending government to influnece recessions.

A higher interest rate would make it to where less loans are taken out so less money is in circulation.

The FED would do that to fight inflation to decrease the amount of money in circulation.

Did I ask dude?

I learned about monetary and fiscal policy today. Monetary is regulating the amount of money in circulation and Fiscal is promoting economic growth and reduce poverty and regulating amount of money in circulation.

The Fed is in charge of Monetary polciy and its used to fight infland the government, being the president and congress, is in charge of Fiscal policy, and its used to fight recessions.

Monetary can use either RRR or OMO or Discount rate on interest to fight inflation.

RRR is the percent of deposits that banks keep. OMO is the buying and selling of bonds. And discount rate is the interst rate that the FED charges on loans . The impact that that has is it would cause less people to take out loans cause thay cost a lot.

Fiscal policy uses taxes and spending government to influnece recessions.

A higher interest rate would make it to where less loans are taken out so less money is in circulation.

The FED would do that to fight inflation to decrease the amount of money in circulation.

Did I ask dude?

Storyboard Text

- I learned about monetary and fiscal policy today. Monetary is regulating the amount of money in circulation and Fiscal is promoting economic growth and reduce poverty and regulating amount of money in circulation.

- The Fed is in charge of Monetary polciy and its used to fight infland the government, being the president and congress, is in charge of Fiscal policy, and its used to fight recessions.

- Monetary can use either RRR or OMO or Discount rate on interest to fight inflation. RRR is the percent of deposits that banks keep. OMO is the buying and selling of bonds. And discount rate is the interst rate that the FED charges on loans . The impact that that has is it would cause less people to take out loans cause thay cost a lot.

- Fiscal policy uses taxes and spending government to influnece recessions.

- The FED would do that to fight inflation to decrease the amount of money in circulation.

- A higher interest rate would make it to where less loans are taken out so less money is in circulation.

- Did I ask dude?