Storyboard Text

- But there are several issues that can be faced by the insolvency practitioners. First, the shareholders have the advantage of having their liabilities to the firm's creditors restricted to the value of their investment. The downside can be enormous and shareholders who rely on dividends for income will also suffer if the company goes bankrupt

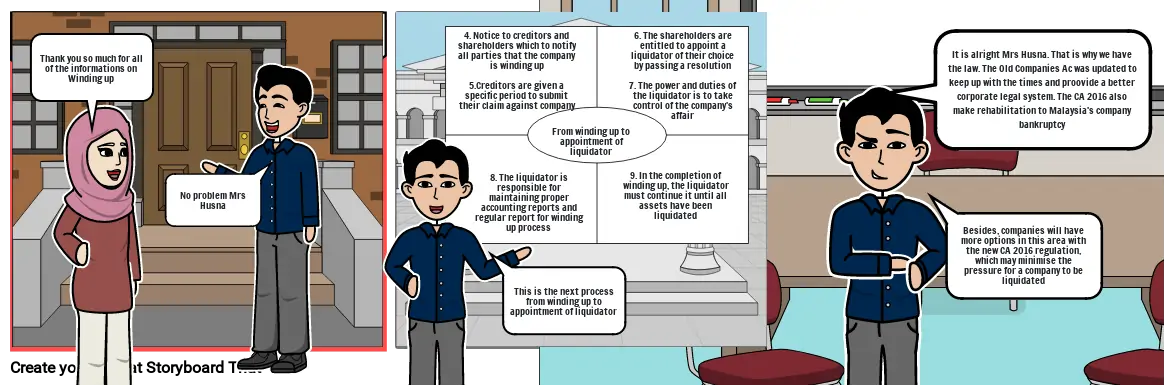

- Thank you so much for all of the informations on Winding up

- No problem Mrs Husna

- 4. Notice to creditors and shareholders which to notify all parties that the company is winding up5.Creditors are given a specific period to submit their claim against company

- 8. The liquidator is responsible for maintaining proper accounting reports and regular report for winding up process

- This is the next process from winding up to appointment of liquidator

- From winding up to appointment of liquidator

- 9. In the completion of winding up, the liquidator must continue it until all assets have been liquidated

- 6. The shareholders are entitled to appoint a liquidator of their choice by passing a resolution 7. The power and duties of the liquidator is to take control of the company's affair

- It is alright Mrs Husna. That is why we have the law. The Old Companies Ac was updated to keep up with the times and proovide a better corporate legal system. The CA 2016 also make rehabilitation to Malaysia's company bankruptcy

- Besides, companies will have more options in this area with the new CA 2016 regulation, which may minimise the pressure for a company to be liquidated

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!