Credit Comic Strip

Storyboard Text

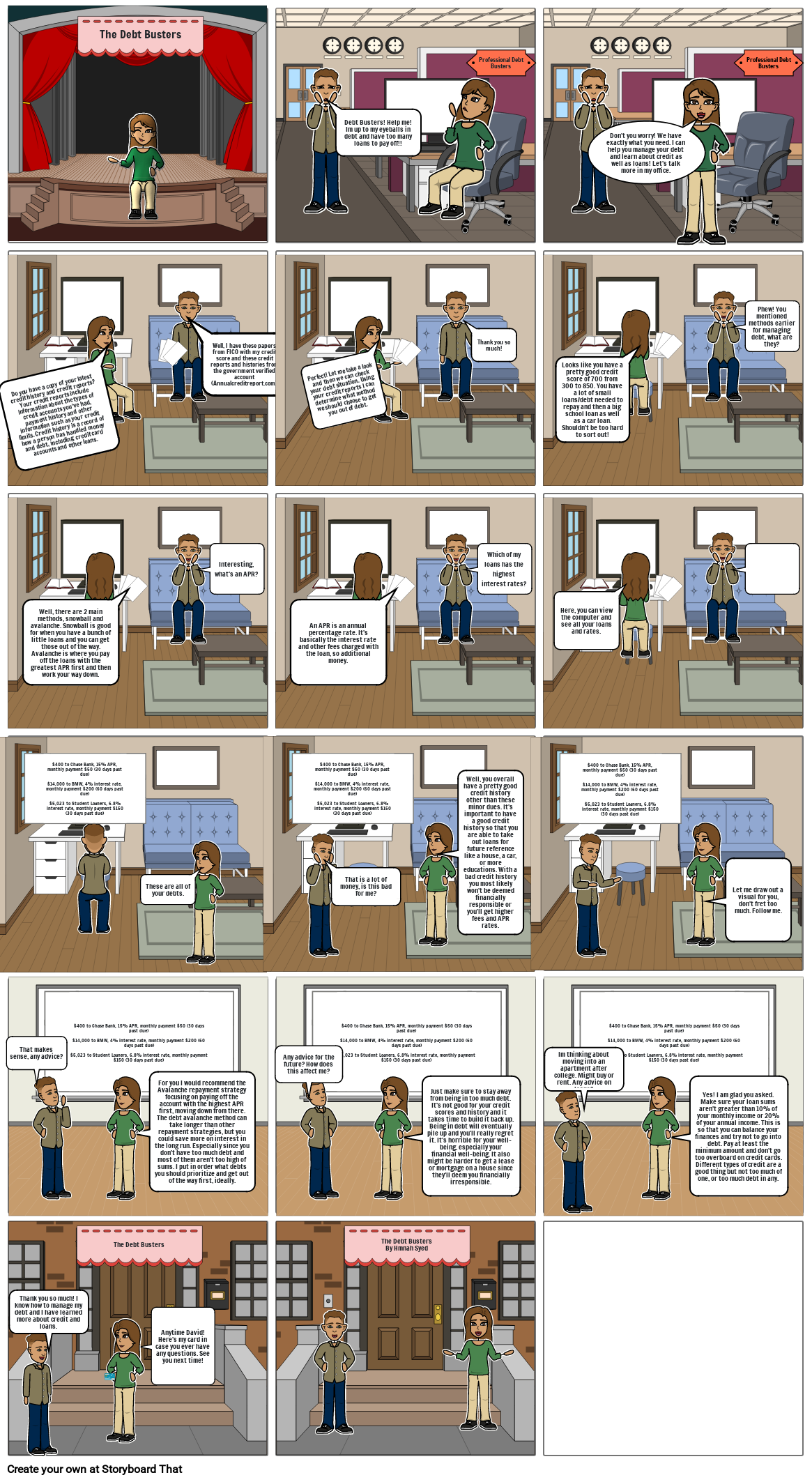

- The Debt Busters

- Debt Busters! Help me! Im up to my eyeballs in debt and have too many loans to pay off!!

- Professional Debt Busters

- Don't you worry! We have exactly what you need. I can help you manage your debt and learn about credit as well as loans! Let's talk more in my office.

- Professional Debt Busters

- Do you have a copy of your latest credit history and credit reports? Your credit reports include information about the types of credit accounts you've had, payment history and other information such as your credit limits. Credit history is a record of how a person has handled money and debt, including credit card accounts and other loans.

- Well, I have these papers from FICO with my credit score and these credit reports and histories from the government verified account (Annualcreditreport.com)

- Perfect! Let me take a look and then we can check your debt situation. Using your credit reports I can determine what method we should choose to get you out of debt.

- Thank you so much!

- Looks like you have a pretty good credit score of 700 from 300 to 850. You have a lot of small loans/debt needed to repay and then a big school loan as well as a car loan. Shouldn't be too hard to sort out!

- Phew! You mentioned methods earlier for managing debt, what are they?

- Well, there are 2 main methods, snowball and avalanche. Snowball is good for when you have a bunch of little loans and you can get those out of the way. Avalanche is where you pay off the loans with the greatest APR first and then work your way down.

- Interesting, what's an APR?

- An APR is an annual percentage rate. It's basically the interest rate and other fees charged with the loan, so additional money.

- Which of my loans has the highest interest rates?

- Here, you can view the computer and see all your loans and rates.

- $400 to Chase Bank, 15% APR, monthly payment $50 (30 days past due)$14,000 to BMW, 4% interest rate, monthly payment $200 (60 days past due)$5,023 to Student Loaners, 6.8% interest rate, monthly payment $150 (30 days past due)

- These are all of your debts.

- $400 to Chase Bank, 15% APR, monthly payment $50 (30 days past due)$14,000 to BMW, 4% interest rate, monthly payment $200 (60 days past due)$5,023 to Student Loaners, 6.8% interest rate, monthly payment $150 (30 days past due)

- That is a lot of money, is this bad for me?

- Well, you overall have a pretty good credit history other than these minor dues. It's important to have a good credit history so that you are able to take out loans for future reference like a house, a car, or more educations. With a bad credit history you most likely won't be deemed financially responsible or you'll get higher fees and APR rates.

- $400 to Chase Bank, 15% APR, monthly payment $50 (30 days past due)$14,000 to BMW, 4% interest rate, monthly payment $200 (60 days past due)$5,023 to Student Loaners, 6.8% interest rate, monthly payment $150 (30 days past due)

- Let me draw out a visual for you, don't fret too much. Follow me.

- That makes sense, any advice?

- $400 to Chase Bank, 15% APR, monthly payment $50 (30 days past due)$14,000 to BMW, 4% interest rate, monthly payment $200 (60 days past due)$5,023 to Student Loaners, 6.8% interest rate, monthly payment $150 (30 days past due)

- For you I would recommend the Avalanche repayment strategy focusing on paying off the account with the highest APR first, moving down from there. The debt avalanche method can take longer than other repayment strategies, but you could save more on interest in the long run. Especially since you don't have too much debt and most of them aren't too high of sums. I put in order what debts you should prioritize and get out of the way first, ideally.

- $400 to Chase Bank, 15% APR, monthly payment $50 (30 days past due)$14,000 to BMW, 4% interest rate, monthly payment $200 (60 days past due)$5,023 to Student Loaners, 6.8% interest rate, monthly payment $150 (30 days past due)

- Just make sure to try and stay away from being in too much debt. It's not good for your credit and it takes time to build it back up. Being in debt will also eventually pile up and you'll really regret it. It's horrible for your well-being, especially your financial well-being. It also might be harder to get a lease or mortgage on a house.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!