ica2

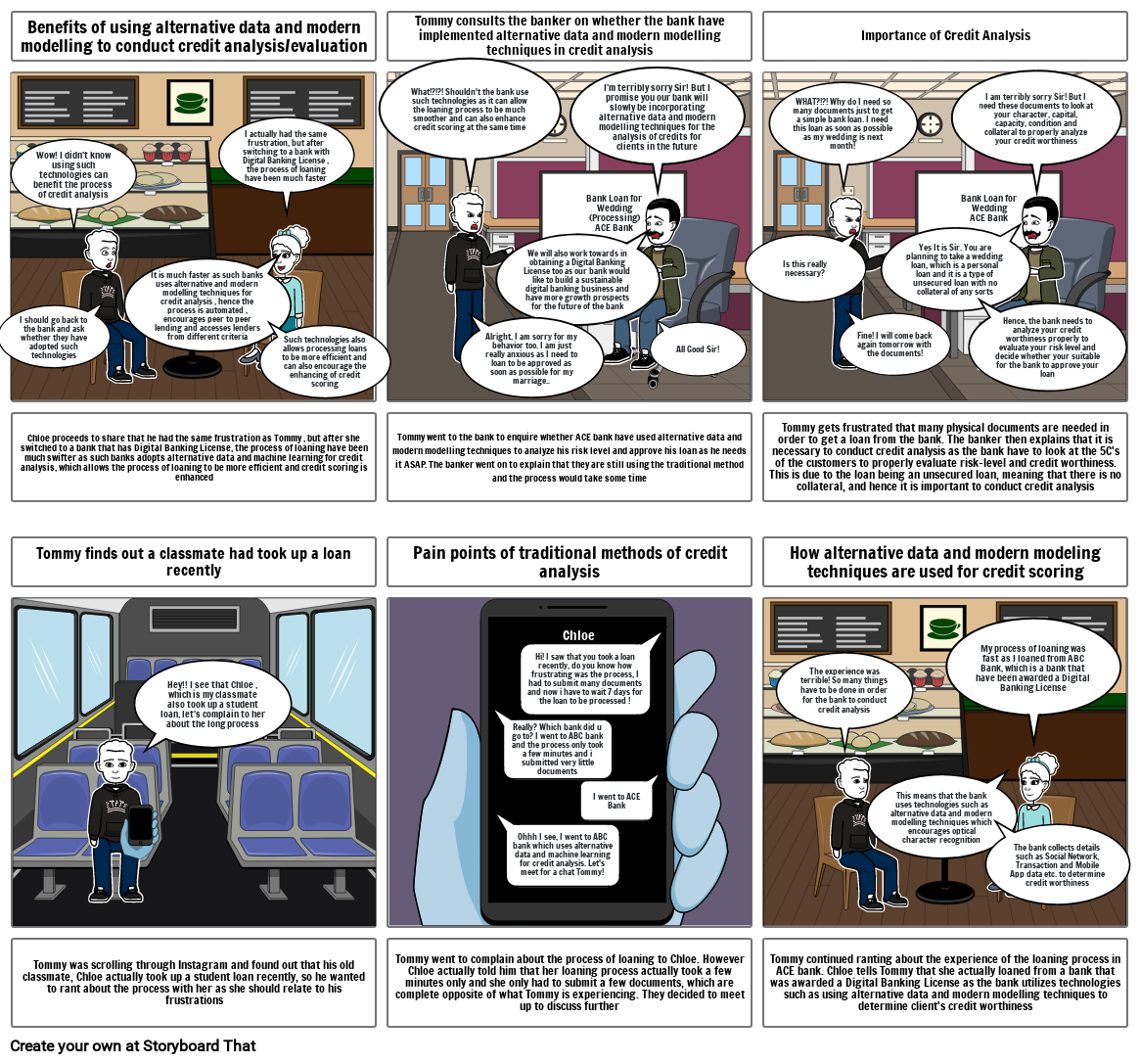

Storyboard Text

- I should go back to the bank and ask whether they have adopted such technologies

- Wow! I didn't know using such technologies can benefit the process of credit analysis

- Benefits of using alternative data and modern modelling to conduct credit analysis/evaluation

- It is much faster as such banks uses alternative and modern modelling techniques for credit analysis , hence the process is automated , encourages peer to peer lending and accesses lenders from different criteria

- I actually had the same frustration, but after switching to a bank with Digital Banking License , the process of loaning have been much faster

- Such technologies also allows processing loans to be more efficient and can also encourage the enhancing of credit scoring

- What!?!?! Shouldn't the bank use such technologies as it can allow the loaning process to be much smoother and can also enhance credit scoring at the same time

- Tommy consults the banker on whether the bank have implemented alternative data and modern modelling techniques in credit analysis

- Alright, I am sorry for my behavior too. I am just really anxious as I need to loan to be approved as soon as possible for my marriage..

- We will also work towards in obtaining a Digital Banking License too as our bank would like to build a sustainable digital banking business and have more growth prospects for the future of the bank

- I'm terribly sorry Sir! But I promise you our bank will slowly be incorporating alternative data and modern modelling techniques for the analysis of credits for clients in the future

- Bank Loan for Wedding (Processing)ACE Bank

-

- All Good Sir!

- Is this really necessary?

- Importance of Credit Analysis

- WHAT?!?! Why do I need so many documents just to get a simple bank loan. I need this loan as soon as possible as my wedding is next month!

- Fine! I will come back again tomorrow with the documents!

- Yes It is Sir. You are planning to take a wedding loan, which is a personal loan and it is a type of unsecured loan with no collateral of any sorts

- Bank Loan for WeddingACE Bank

- I am terribly sorry Sir! But I need these documents to look at your character, capital, capacity, condition and collateral to properly analyze your credit worthiness

- Hence, the bank needs to analyze your credit worthiness properly to evaluate your risk level and decide whether your suitable for the bank to approve your loan

- Chloe proceeds to share that he had the same frustration as Tommy , but after she switched to a bank that has Digital Banking License, the process of loaning have been much swifter as such banks adopts alternative data and machine learning for credit analysis, which allows the process of loaning to be more efficient and credit scoring is enhanced

- Tommy finds out a classmate had took up a loan recently

- Hey!! I see that Chloe , which is my classmate also took up a student loan, let's complain to her about the long process

- Tommy went to the bank to enquire whether ACE bank have used alternative data and modern modelling techniques to analyze his risk level and approve his loan as he needs it ASAP. The banker went on to explain that they are still using the traditional method and the process would take some time

- Pain points of traditional methods of credit analysis

- Hi! I saw that you took a loan recently, do you know how frustrating was the process, I had to submit many documents and now i have to wait 7 days for the loan to be processed !

- Chloe

- Tommy gets frustrated that many physical documents are needed in order to get a loan from the bank. The banker then explains that it is necessary to conduct credit analysis as the bank have to look at the 5C's of the customers to properly evaluate risk-level and credit worthiness. This is due to the loan being an unsecured loan, meaning that there is no collateral, and hence it is important to conduct credit analysis

- How alternative data and modern modeling techniques are used for credit scoring

- The experience was terrible! So many things have to be done in order for the bank to conduct credit analysis

- My process of loaning was fast as I loaned from ABC Bank, which is a bank that have been awarded a Digital Banking License

- Tommy was scrolling through Instagram and found out that his old classmate, Chloe actually took up a student loan recently, so he wanted to rant about the process with her as she should relate to his frustrations

- Tommy went to complain about the process of loaning to Chloe. However Chloe actually told him that her loaning process actually took a few minutes only and she only had to submit a few documents, which are complete opposite of what Tommy is experiencing. They decided to meet up to discuss further

- Really? Which bank did u go to? I went to ABC bank and the process only took a few minutes and i submitted very little documents

- Ohhh I see, I went to ABC bank which uses alternative data and machine learning for credit analysis. Let's meet for a chat Tommy!

- I went to ACE Bank

- Tommy continued ranting about the experience of the loaning process in ACE bank. Chloe tells Tommy that she actually loaned from a bank that was awarded a Digital Banking License as the bank utilizes technologies such as using alternative data and modern modelling techniques to determine client's credit worthiness

- This means that the bank uses technologies such as alternative data and modern modelling techniques which encourages optical character recognition

- The bank collects details such as Social Network, Transaction and Mobile App data etc. to determine credit worthiness

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!