Budgeting

Storyboard Text

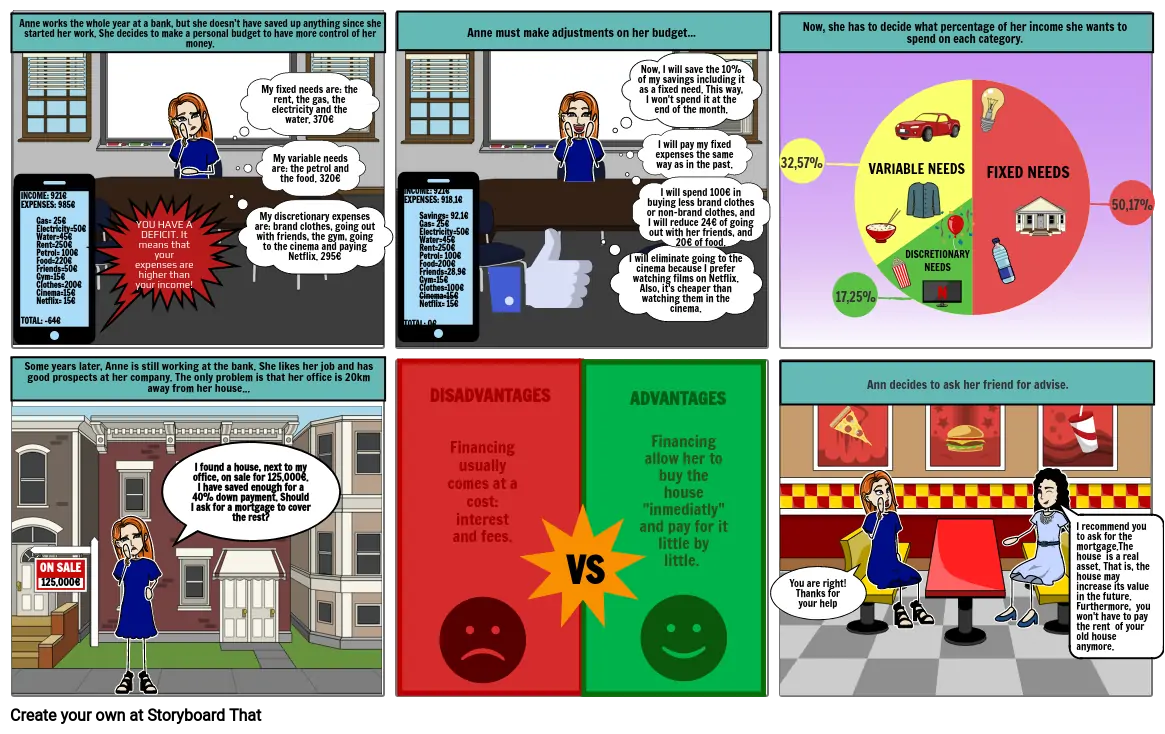

- Anne works the whole year at a bank, but she doesn’t have saved up anything since she started her work. She decides to make a personal budget to have more control of her money.

- INCOME: 921€EXPENSES: 985€ Gas= 25€ Electricity=50€ Water=45€ Rent=250€ Petrol= 100€ Food=220€ Friends=50€ Gym=15€ Clothes=200€ Cinema=15€ Netflix= 15€TOTAL: -64€

- YOU HAVE A DEFICIT. It means that your expenses are higher than your income!

- My discretionary expenses are: brand clothes, going out with friends, the gym, going to the cinema and paying Netflix. 295€

- My fixed needs are: the rent, the gas, the electricity and the water. 370€

- My variable needs are: the petrol and the food. 320€

- INCOME: 921€EXPENSES: 918.1€ Savings= 92.1€ Gas= 25€ Electricity=50€ Water=45€ Rent=250€ Petrol= 100€ Food=200€ Friends=28.9€ Gym=15€ Clothes=100€ Cinema=15€ Netflix= 15€TOTAL: 0€

- Anne must make adjustments on her budget...

- DISADVANTAGES

- I will eliminate going to the cinema because I prefer watching films on Netflix. Also, it's cheaper than watching them in the cinema.

- Now, I will save the 10% of my savings including it as a fixed need. This way, I won't spend it at the end of the month.

- ADVANTAGES

- I will pay my fixed expenses the same way as in the past.

- I will spend 100€ in buying less brand clothes or non-brand clothes, and I will reduce 24€ of going out with her friends, and 20€ of food.

- 32,57%

- Ann decides to ask her friend for advise.

- Now, she has to decide what percentage of her income she wants to spend on each category.

- 17,25%

- VARIABLE NEEDS

- DISCRETIONARY NEEDS

- N

- FIXED NEEDS

- 50,17%

- Some years later, Anne is still working at the bank. She likes her job and has good prospects at her company. The only problem is that her office is 20km away from her house...

- ON SALE 125.000€

- I found a house, next to my office, on sale for 125.000€. I have saved enough for a 40% down payment. Should I ask for a mortgage to cover the rest?

-

- Financing usually comes at a cost: interestand fees.

- VS

- Financing allow her to buy the house "inmediatly" and pay for it little by little.

- You are right! Thanks for your help

- I recommend you to ask for the mortgage.The house is a real asset. That is, the house may increase its value in the future. Furthermore, you won't have to pay the rent of your old house anymore.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!