Untitled Storyboard

Storyboard Text

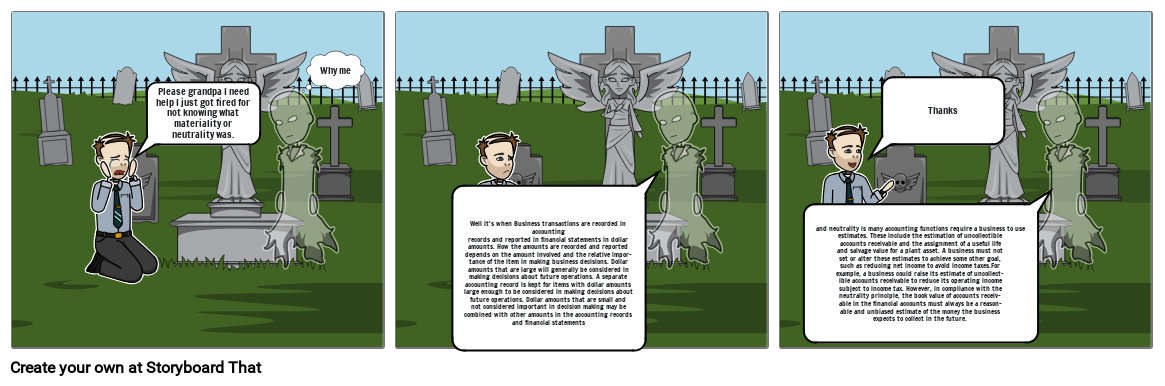

- Slide: 1

- Why me

- Please grandpa I need help I just got fired for not knowing what materiality or neutrality was.

- Slide: 2

- Well it's when Business transactions are recorded in accountingrecords and reported in financial statements in dollaramounts. How the amounts are recorded and reporteddepends on the amount involved and the relative impor-tance of the item in making business decisions. Dollaramounts that are large will generally be considered inmaking decisions about future operations. A separateaccounting record is kept for items with dollar amountslarge enough to be considered in making decisions aboutfuture operations. Dollar amounts that are small andnot considered important in decision making may becombined with other amounts in the accounting recordsand financial statements

- Slide: 3

- Thanks

- and neutrality is many accounting functions require a business to useestimates. These include the estimation of uncollectibleaccounts receivable and the assignment of a useful lifeand salvage value for a plant asset. A business must notset or alter these estimates to achieve some other goal,such as reducing net income to avoid income taxes.Forexample, a business could raise its estimate of uncollect-ible accounts receivable to reduce its operating incomesubject to income tax. However, in compliance with theneutrality principle, the book value of accounts receiv-able in the financial accounts must always be a reason-able and unbiased estimate of the money the businessexpects to collect in the future.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!