Project

Storyboard Description

Mr. Rivard

Storyboard Text

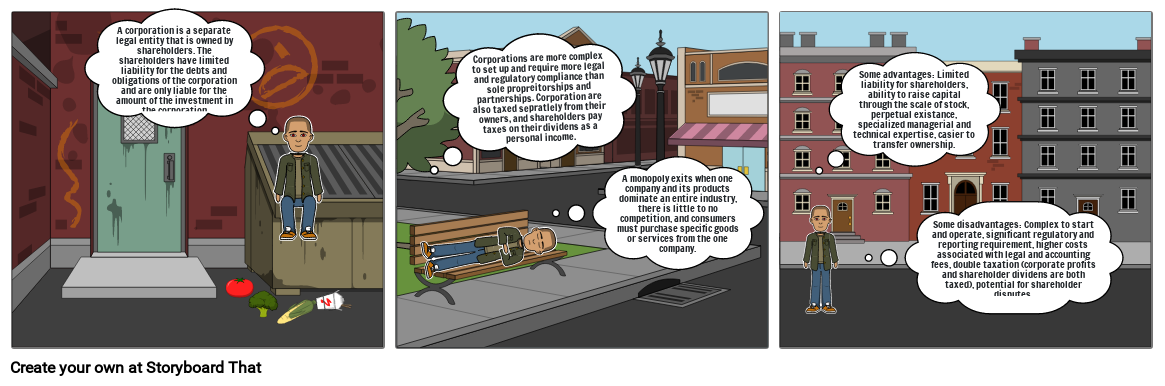

- A corporation is a separate legal entity that is owned by shareholders. The shareholders have limited liability for the debts and obligations of the corporation and are only liable for the amount of the investment in the corporation

- Corporations are more complex to set up and require more legal and regulatory compliance than sole propreitorships and partnerships. Corporation are also taxed sepratlely from their owners, and shareholders pay taxes on their dividens as a personal income.

- A monopoly exits when one company and its products dominate an entire industry, there is little to no competition, and consumers must purchase specific goods or services from the one company.

- Some advantages: Limited liability for shareholders, ability to raise capital through the scale of stock, perpetual existance, specialized managerial and technical expertise, casier to transfer ownership.

- Some disadvantages: Complex to start and operate, significant regulatory and reporting requirement, higher costs associated with legal and accounting fees, double taxation (corporate profits and shareholder dividens are both taxed), potential for shareholder disputes.

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!