Unknown Story

Storyboard Text

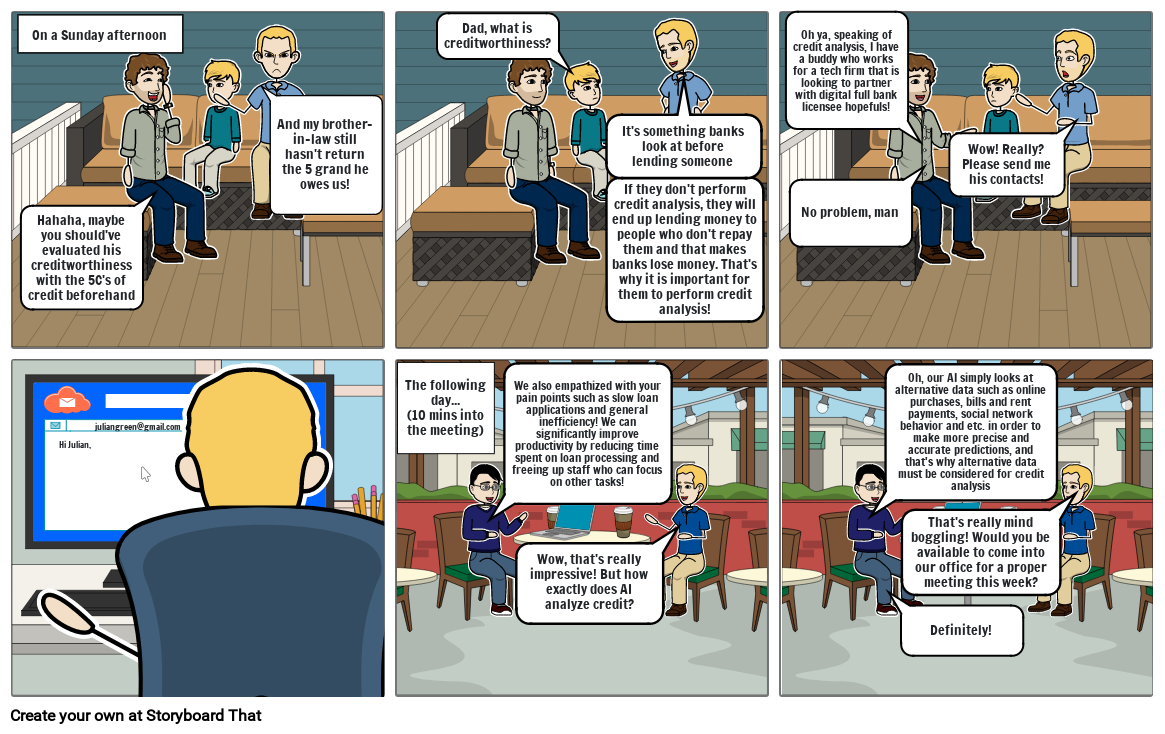

- On a Sunday afternoon

- The following day... (10 mins into the meeting)

- Hahaha, maybe you should've evaluated his creditworthiness with the 5C's of credit beforehand

- We also empathized with your pain points such as slow loan applications and general inefficiency! We can significantly improve productivity by reducing time spent on loan processing and freeing up staff who can focus on other tasks!

- Wow, that's really impressive! But how exactly does AI analyze credit?

- And my brother-in-law still hasn't return the 5 grand he owes us!

- Dad, what is creditworthiness?

- If they don't perform credit analysis, they will end up lending money to people who don't repay them and that makes banks lose money. That's why it is important for them to perform credit analysis!

- It's something banks look at before lending someone money!

- Oh ya, speaking of credit analysis, I have a buddy who works for a tech firm that is looking to partner with digital full bank licensee hopefuls!

- No problem, man

- Wow! Really? Please send me his contacts!

- Hi Julian,

- juliangreen@gmail.com

- Oh, our AI simply looks at alternative data such as online purchases, bills and rent payments, social network behavior and etc. in order to make more precise and accurate predictions, and that's why alternative data must be considered for credit analysis

- Definitely!

- That's really mind boggling! Would you be available to come into our office for a proper meeting this week?

Over 30 Million Storyboards Created

No Downloads, No Credit Card, and No Login Needed to Try!