Credit and Budget story

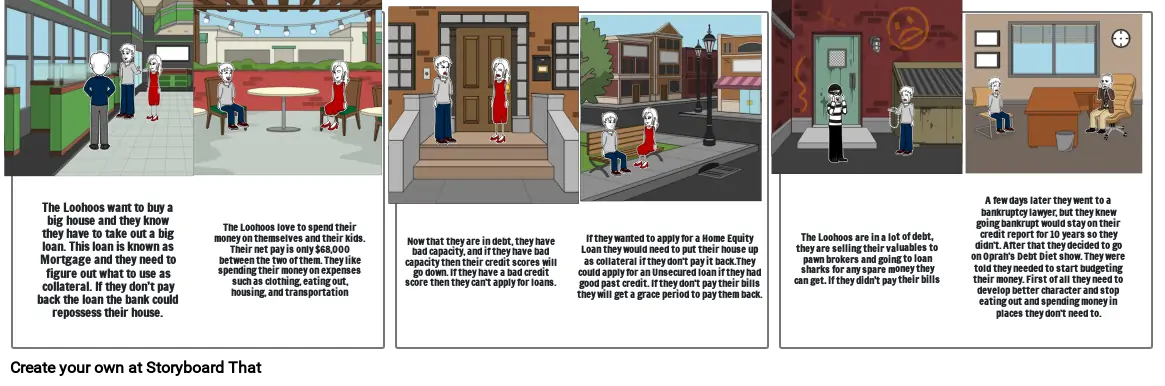

The Loohoos want to buy a big house and they know they have to take out a big loan. This loan is known as Mortgage and they need to figure out what to use as collateral. If they don’t pay back the loan the bank could repossess their house.

The Loohoos love to spend their money on themselves and their kids. Their net pay is only $68,000 between the two of them. They like spending their money on expenses such as clothing, eating out, housing, and transportation

Now that they are in debt, they have bad capacity, and if they have bad capacity then their credit scores will go down. If they have a bad credit score then they can’t apply for loans.

If they wanted to apply for a Home Equity Loan they would need to put their house up as collateral if they don’t pay it back.They could apply for an Unsecured loan if they had good past credit. If they don't pay their bills they will get a grace period to pay them back.

The Loohoos are in a lot of debt, they are selling their valuables to pawn brokers and going to loan sharks for any spare money they can get. If they didn’t pay their bills

A few days later they went to a bankruptcy lawyer, but they knew going bankrupt would stay on their credit report for 10 years so they didn’t. After that they decided to go on Oprah’s Debt Diet show. They were told they needed to start budgeting their money. First of all they need to develop better character and stop eating out and spending money in places they don’t need to.

The Loohoos want to buy a big house and they know they have to take out a big loan. This loan is known as Mortgage and they need to figure out what to use as collateral. If they don’t pay back the loan the bank could repossess their house.

The Loohoos love to spend their money on themselves and their kids. Their net pay is only $68,000 between the two of them. They like spending their money on expenses such as clothing, eating out, housing, and transportation

Now that they are in debt, they have bad capacity, and if they have bad capacity then their credit scores will go down. If they have a bad credit score then they can’t apply for loans.

If they wanted to apply for a Home Equity Loan they would need to put their house up as collateral if they don’t pay it back.They could apply for an Unsecured loan if they had good past credit. If they don't pay their bills they will get a grace period to pay them back.

The Loohoos are in a lot of debt, they are selling their valuables to pawn brokers and going to loan sharks for any spare money they can get. If they didn’t pay their bills

A few days later they went to a bankruptcy lawyer, but they knew going bankrupt would stay on their credit report for 10 years so they didn’t. After that they decided to go on Oprah’s Debt Diet show. They were told they needed to start budgeting their money. First of all they need to develop better character and stop eating out and spending money in places they don’t need to.

The Loohoos want to buy a big house and they know they have to take out a big loan. This loan is known as Mortgage and they need to figure out what to use as collateral. If they don’t pay back the loan the bank could repossess their house.

The Loohoos love to spend their money on themselves and their kids. Their net pay is only $68,000 between the two of them. They like spending their money on expenses such as clothing, eating out, housing, and transportation

Now that they are in debt, they have bad capacity, and if they have bad capacity then their credit scores will go down. If they have a bad credit score then they can’t apply for loans.

If they wanted to apply for a Home Equity Loan they would need to put their house up as collateral if they don’t pay it back.They could apply for an Unsecured loan if they had good past credit. If they don't pay their bills they will get a grace period to pay them back.

The Loohoos are in a lot of debt, they are selling their valuables to pawn brokers and going to loan sharks for any spare money they can get. If they didn’t pay their bills

A few days later they went to a bankruptcy lawyer, but they knew going bankrupt would stay on their credit report for 10 years so they didn’t. After that they decided to go on Oprah’s Debt Diet show. They were told they needed to start budgeting their money. First of all they need to develop better character and stop eating out and spending money in places they don’t need to.

The Loohoos want to buy a big house and they know they have to take out a big loan. This loan is known as Mortgage and they need to figure out what to use as collateral. If they don’t pay back the loan the bank could repossess their house.

The Loohoos love to spend their money on themselves and their kids. Their net pay is only $68,000 between the two of them. They like spending their money on expenses such as clothing, eating out, housing, and transportation

Now that they are in debt, they have bad capacity, and if they have bad capacity then their credit scores will go down. If they have a bad credit score then they can’t apply for loans.

If they wanted to apply for a Home Equity Loan they would need to put their house up as collateral if they don’t pay it back.They could apply for an Unsecured loan if they had good past credit. If they don't pay their bills they will get a grace period to pay them back.

The Loohoos are in a lot of debt, they are selling their valuables to pawn brokers and going to loan sharks for any spare money they can get. If they didn’t pay their bills

A few days later they went to a bankruptcy lawyer, but they knew going bankrupt would stay on their credit report for 10 years so they didn’t. After that they decided to go on Oprah’s Debt Diet show. They were told they needed to start budgeting their money. First of all they need to develop better character and stop eating out and spending money in places they don’t need to.

Storyboard Text

- The Loohoos want to buy a big house and they know they have to take out a big loan. This loan is known as Mortgage and they need to figure out what to use as collateral. If they don’t pay back the loan the bank could repossess their house.

- The Loohoos love to spend their money on themselves and their kids. Their net pay is only $68,000 between the two of them. They like spending their money on expenses such as clothing, eating out, housing, and transportation

- Now that they are in debt, they have bad capacity, and if they have bad capacity then their credit scores will go down. If they have a bad credit score then they can’t apply for loans.

- If they wanted to apply for a Home Equity Loan they would need to put their house up as collateral if they don’t pay it back.They could apply for an Unsecured loan if they had good past credit. If they don't pay their bills they will get a grace period to pay them back.

- The Loohoos are in a lot of debt, they are selling their valuables to pawn brokers and going to loan sharks for any spare money they can get. If they didn’t pay their bills

- A few days later they went to a bankruptcy lawyer, but they knew going bankrupt would stay on their credit report for 10 years so they didn’t. After that they decided to go on Oprah’s Debt Diet show. They were told they needed to start budgeting their money. First of all they need to develop better character and stop eating out and spending money in places they don’t need to.